Brent oil futures prices inched down to $64.36 a barrel while WTI oil futures are Moving flat at $60.58 a barrel at the time of reporting. Both the benchmarks set to close the month at 3 pct loss. Trade Truce between U.S and China is the talk of the town. Larger than expected draw down in U.S stocks keep supporting WTI. Fed Int rate cut expected to boost economic activity. OPEC+ meet scheduled on Nov 2nd. The suppliers group expected to add 137000 bpd. Rig nos are awaited.

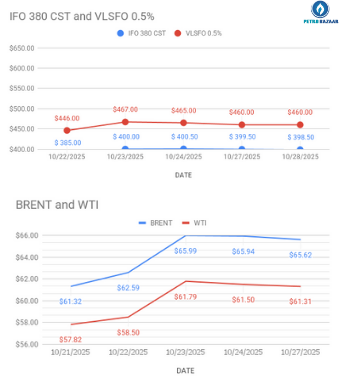

Fuel oil markets trading down. Spot differentials for both benchmarks, VLSFO and HSFO continued to dip down. Prompt market structure showed further signs of softening. The time spreads for both 180 cSt and 380 cSt traded into deeper contsngo on selling pressure. The price weakness triggered by ample supplies across the market. FO LDO prices are likely go down for the 1H Nov.

Faq: what is spot differentials? Spot differentials price is the diff between immediate ‘Spot price’ and benchmark price.