By Srinivas Chowdary Sunkara // petrobazaar // 16th June, 2022.

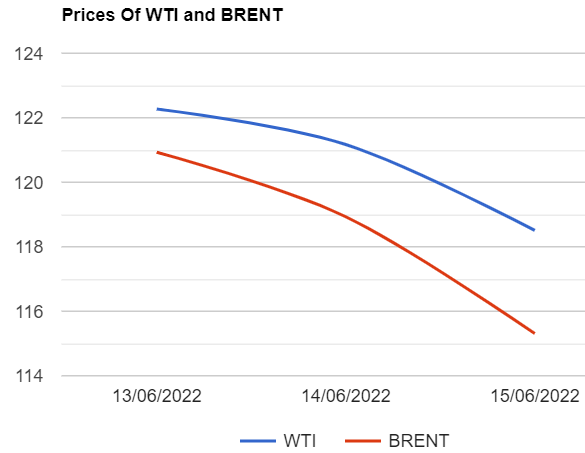

Brent oil futures prices for August settlement fell $2.66 or 2.2 pct to close at $118.51 a barrel on London based ICE futures Europe exchange while WTI oil futures to be delivered in July settled down $3.62 or 3.04 % to $115.31 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slumped 16.8 Yuan to 758 Yuan where as MCX crude oil front month futures prices tumbled Rs.221 or 2.35 pct to Rs.9177 a barrel yesterday. Brent traded at a premium of $3.2 a barrel on WTI during the session.

The world crude oil price index curves continued to fall yesterday following the previous session. Both the benchmark prices slumped on demand fears following the Federal Reserve hiked interest rate by three-quarters of a percentage point. Bearish weekly numbers and strong greenback also pressed oil prices yesterday. Turning to weekly numbers, U.S crude and gasoline stocks were drawn by 5.8 Mbpd and 0.7Mbpd respectively while distillates stocks were up by 0.7Mbpd last week. U.S domestic production was ramped up by 100000 barrels that surprised market. Boost in exports with a slippage in imports might have caused drop in crude stocks.

Supply shortage fears prevailed in the market while OPEC producers are struggling to meet monthly quotas due to recent political crisis that has reduced Libya's output. As per analysts, OPEC production is noticeably falling short of the announced level. This will result in 1.5Mbpd deficit on the oil market in the second quarter. Asian markets opened in green, clawing back some of yesterday's losses. Both the benchmarks are trading up at the time of reporting. Oil futures are moving towards weekly loss and rig numbers are awaited.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com