Key Supplies

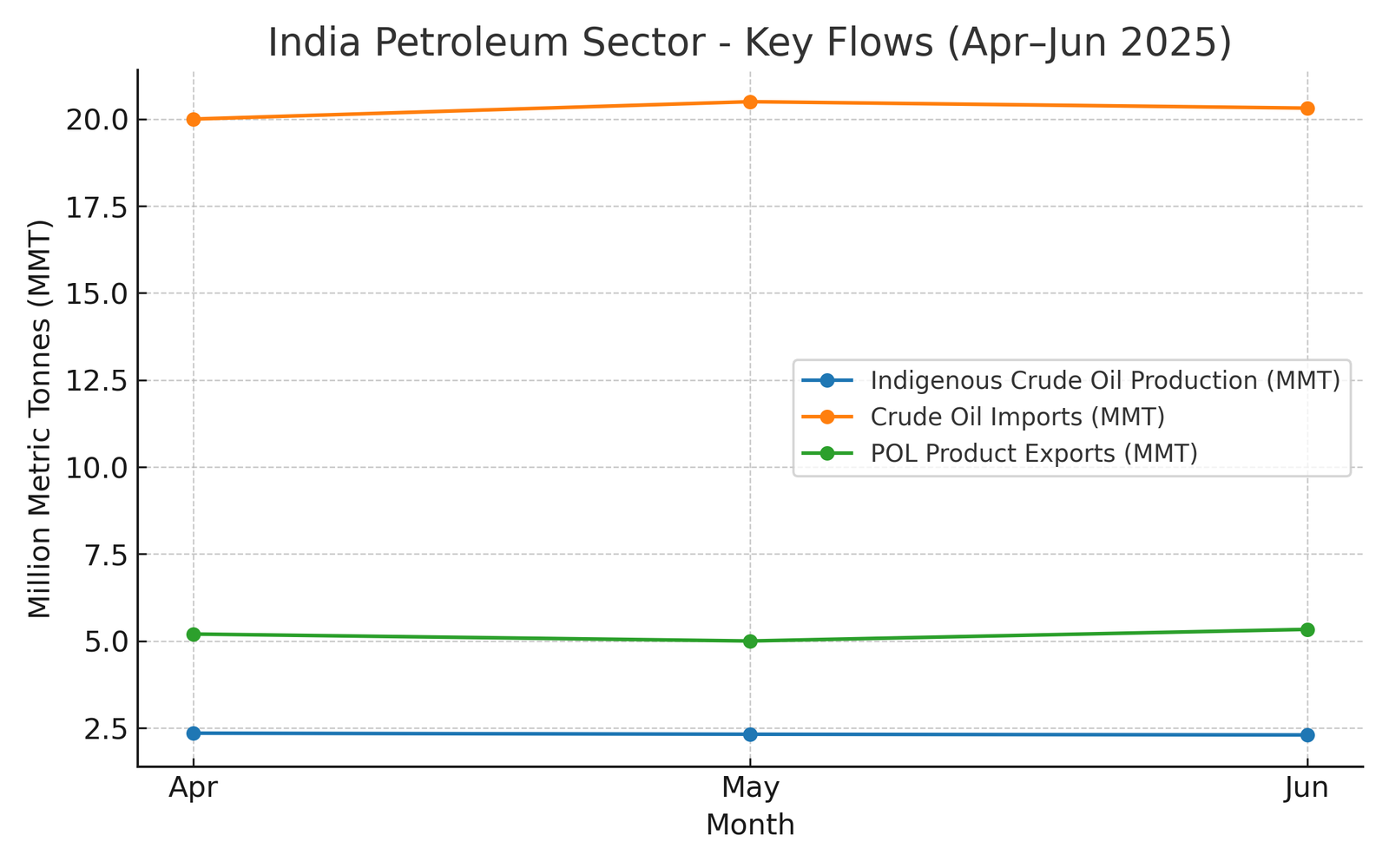

- Indigenous crude oil output: 2.3 MMT in June 2025 (-0.5% YoY), showing flat-to-declining domestic supply pressure.

- Crude processing: 22.1 MMT in June (-0.4% YoY); PSU/JV refiners 14.8 MMT, private refiners 7.3 MMT. Slight 0.3% growth in Apr–Jun FY25-26 vs prior year.

- Product output: 23.5 MMT (+3.3% YoY), with diesel (HSD) holding the largest share (41.7%), followed by gasoline (MS) at 17%, naphtha and ATF each 6.3%.

- High sulphur crude remains dominant at ~78% of processed feedstock — suggests continued dependency on cheaper grades.

Trade Flows & Market Tightness

- Crude imports: 20.315 MMT in June (+8.0% YoY), OPEC share rose to 47.9% from 45.5%.

- Product imports: +19.7% YoY in June, led by LPG (41.2% share), petcoke (25.2%), FO (10.9%).

- Product exports: +7.2% YoY in June; diesel (39.2% share) and gasoline (26.3%) dominate export basket.