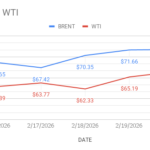

Brent oil Jan futures are trading 56 cents down to $80.02 while WTI oil futures for Jan delivery inched down 60 cents to $74.94 a barrel on Monday morning during Asian hours. Both the benchmarks moved up slightly last week logged in weekly gains, first of last five sessions. Brent premium over WTI widened to $5.04 a barrel last week.

The world crude oil price index curves continue to demonstrate down side momentum today amid prevailing negative sentiment across the market. crude markets are looking at OPEC+ meet that postponed to 30th Nov. The spearhead, KSA and Russia are very likely to roll over cuts to next quarter. Consensus is awaited in African producers on base lines. Benchmarks seesawed last week on OPEC+ meeting and deepening supply cuts predictions. Turning to technicals, ICE announced that Portfolio managers reduced their net length in Brent futures and options by 15880 contracts to the week Nov 21st. Longs left the market while short positions are also trimmed. CFTC will release data today due to thanksgiving holiday last week in U.S

crude markets remained range bound due to lack of fundamental clues. Chinese demand numbers, U.S weekly numbers and OPEC supply cuts news will spur some volatility in the market during the week.