Crude:

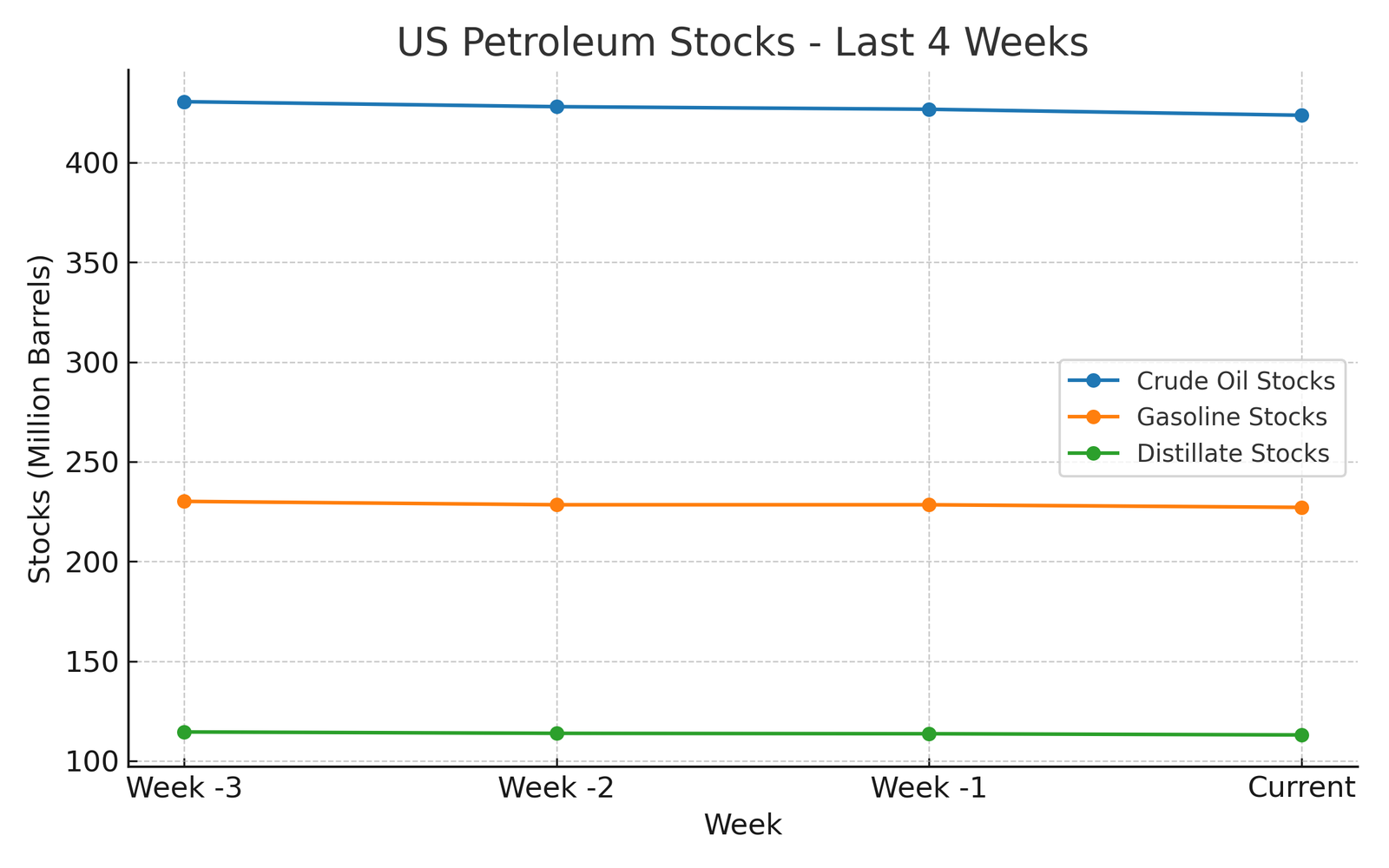

- Commercial crude stocks -3.0 mb w/w to 423.7 mb; ~6% below 5-yr avg. SPR 403.0 mb.

- Runs high: refinery utilization 96.9% (+0.3 pp); crude inputs 17.1 mb/d (+213 kb/d). Tight balances with high runs tend to support WTI.

- Net exports remain wide: 4-wk total net imports -2.483 mb/d (products net exports -5.249 mb/d), tightening domestic supply.

- Price context: WTI $68.39 (+$2.01 w/w; -$6.60 y/y). Momentum positive w/w.

Gasoline:

- Stocks -1.3 mb to 227.1 mb; ~1% below 5-yr avg. Production eased to 9.8 mb/d.

- Demand soft: 4-wk product supplied 8.912 mb/d (-2.2% y/y). Limited fundamental upside for RBOB unless driving picks up or runs slip.

- NYH spot $2.118/gal (+0.021 w/w; -0.21 y/y).

Distillate:

- Stocks -0.6 mb to 113.0 mb; ~16% below 5-yr avg — structurally tight.

- Demand: 4-wk product supplied 3.523 mb/d (-3.8% y/y). Despite softer pull, low inventories support ULSD/heating oil cracks. NYH ULSD $2.339/gal (-$0.109 w/w).

Jet & Propane:

- Jet demand up 3.8% y/y (4-wk), supportive for middle distillate margins.

- Propane stocks +1.3 mb w/w; 8% above 5-yr avg — neutral/bearish propane into late summer.

Refining & flows:

- High utilization (96.9%) keeps product supply robust; any unplanned outages or early maintenance would quickly tighten gasoline/distillate given low distillate cushion.

- Crude imports 6.0 mb/d last week; 4-wk avg ~6.1 mb/d (-9.7% y/y) — less import reliance supports domestic crude draws.