By Srinivas Chowdary Sunkara//petrobazaar // 29th May, 2018.

Panic sell-off

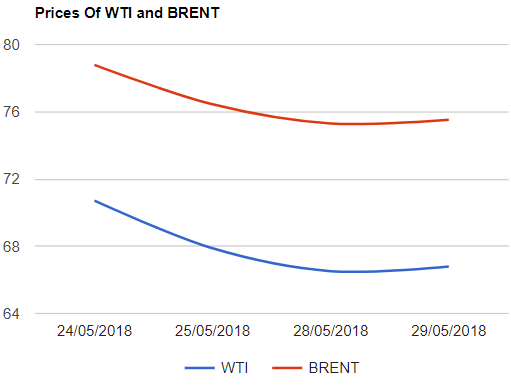

On Monday, Brent lost 1.49% where as WTI was down by 2Pc after a sharp fall of 4% on Friday. Oil prices slid on panic sell-off on the concerns of rising U.S production along with the OPEC and non-OPEC countries turning back to boost output by 1Mbpd in 2H18 which still needs to be discussed in the scheduled meet on June 22nd.

On the other hand, Doubts remains over the finalisation and execution of the new agreement are keeping the prices in control from further slip. Shale oil is not able to hit global markets due to infrastructure bottlenecks around U.S oil industry resulting into local over supply led into discounting WTI by around 9% as reported.

Crude oil price update

Yesterday, U.S crude futures to be delivered in July have fallen by $1.36 to close at $66.52 a barrel on NYMEX while July Brent futures lost $1.14 at $75.3 per barrel on London based ICE futures Europe exchange. In U.S there was no settlement due to U.S memorial Day holiday all trades will be booked on Tuesday. Shanghai futures and MCX futures changed a little. Today Asian markets are mixed. Brent futures are little increased while WTI futures are on downside at the time of reporting.

Comment

Market is digesting the unofficial news of top producers boosting the output and is already priced in. Strong dollar is weighing on. API weekly stats are due today.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com