By Srinivas Chowdary Sunkara // petrobazaar // 28th June, 2018.

U.S oil price at high

Yesterday, Both the benchmark prices continued Tuesday's rally and U.S oil price settled at highest since 2014. Largest drop in U.S crude stocks as reported by EIA and U.S threat to its allies to stop imports from Iran could drive the oil prices to its highest level. Supply outage in Canada to the tune of 300 Kbpd also caused the concern.

Today, Asian markets are opened down as the markets are in the opinion that physical markets are well supplied despite of ongoing supply disruptions and demand growth.

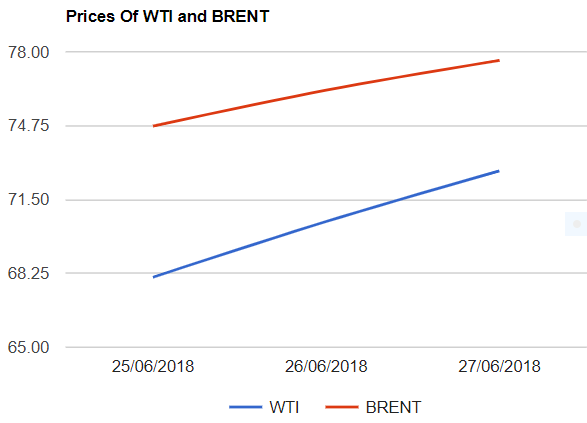

Crude oil price update

Yesterday, U.S crude futures for August delivery closed high by $2.23 or 3.16 pct at $72.76 a barrel on Nymex where as Brent August futures rose by $1.31 or 1.72% at $77.62 per barrel on London based ICE futures Europe exchange. Both the Shanghai and MCX futures closed upside. Crude futures in Asian markets opened down and trading at low levels from previous closing.

EIA report – summary

The Energy Information Administration released its weekly statistics in U.S for the week ending 22nd June. Crude oil stocks were reportedly slid by 9.9 Mb, a decrease of 0.9% from last week. Gasoline stocks were increased by 1.2Mb while the distillates numbers were unchanged. Domestic production remained unchanged at 10.9Mbpd. Net imports were decreased while exports were increased. Crude oil inputs into refinery were ramped up with a little increase of 0.8% in refinery utilization. The key hub, Cushing stocks were on downside due to outage in Canada facility.

Comment

It seems that there is no room for bears to play in the short term as the market is reacting to all the news relating to Iran sanctions and spare capacity. U.S sanctions on Iran will come into effect from Nov. Meanwhile some analysts are predicting $90. if one observes the bulls reacted to each comment since the start of 2018. let us face it.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com