By Srinivas Chowdary Sunkara // petrobazaar // 27th June, 2018.

Oil prices spiked on supply disruptions

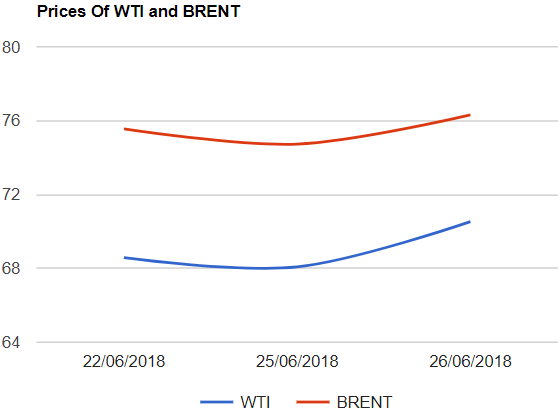

Crude oil prices jumped yesterday after the American Petroleum Institute reported a huge draw in U.S crude stocks against the analysts expectation. The spread was narrowed to around $5.78 from the heights of $11, two weeks ago. Saudi pushed through 1 million barrels of production increase and further more it announced that it has a spare capacity of 2Mbpd to offset any deficit in future which weighed on the Brent. An outage in a Canada facility which supplies 360Kbpd to key storage hubs of U.S Cushing and Oklahoma caused a bullishness for WTI, resulted in narrowing of spread.

Oil prices opened up today on the supply disruptions in Libya and Canada. U.S calling its allies to cut imports from Iran also pushing oil prices up. Trade tariff tensions are continuing pressuring the financial markets. EIA releases weekly stats later today.

Crude oil price update

U.S August crude oil futures prices were jumped by $2.45 or 3.6 pct from its previous close to settle at $70.53 a barrel on Nymex where as Brent futures for August delivery were up by $1.58 with 2.11% increase on London based ICE futures Europe exchange. Shanghai futures were on upside whereas MCX futures lost. Asian markets are trading in positive zone at the time of reporting.

API report – summary

The American Petroleum Institute reported that U.S crude supplies were dropped by 9 Million barrels for the week ending 22nd June. The data also showed a rise in gasoline and distillates by 1.2 Mb and 1.8Mb respectively during the week. EIA report is awaited and consensus is on a fall of 2.3Mb in crude supplies.

Comment

For me, Market trends are not clear and the market yielded nothing from last week meeting. we are entering into 2H18, where demand is expected to rise and global supplies are anticipated to be tighter. Meanwhile i dont find any sustainable long term trend.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com