By Srinivas Chowdary Sunkara // petrobazaar // 23rd May, 2018 10:29 a.m IST

Oil prices eased

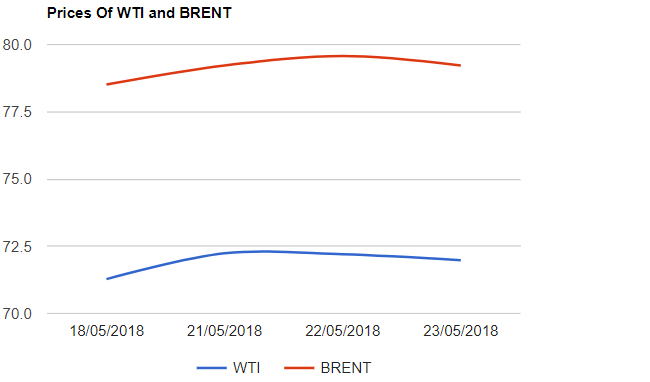

Today, It seems that the oil market preferred to take profit. After yesterday's rally, Brent is at $79.06 and U.S crude is continued with downtrend to trade at $71.91 today. Market took breather on expected increase in OPEC production to compensate Iran's short fall which eased the prices.

Potential drop in Venezuela production, Increasing worries over Iran supply are keeping a floor under the market and finally who knows what will happen with Libya. API released weekly data and expected U.S crude supplies fell by 1.3 Mb for the week ended May, 18. As per API, gasoline stocks were increased by .98Mb while distillates were drawn by 1.3 Mb. EIA report is expected today and consensus is on draws in crude, gasoline and distillates.

Crude oil price update

U.S crude futures for July delivery lost 4 cents to close at $72.2 per barrel on NYMEX while Brent futures to be delivered in July had a rally yesterday and touched $80, could not sustain and closed at $79.57 with 35 cents gains from earlier close on London based ICE futures Europe exchange.

Comment

Oil has been over burdened with so called supporting factors like comments, sanctions, reports and Geo-politics etc. Speculators want the price to go one way – up and just following the headlines to continue decades of tradition in futures markets. Be aware of the facts before loading.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com