By Srinivas Chowdary Sunkara // petrobazaar // 20th June, 2018

Oil prices inched up today

Energy was in focus yesterday. Escalation of trade tariffs between U.S and China pressured financial markets, spilled over to oil markets. Looming OPEC meeting caused bearishness in oil prices yesterday. The proposed trade tariffs caused currency fluctuation which made dollar stronger, kept oil prices in check. Any bits and pieces of news on upcoming OPEC meeting causing volatility. API report of drawings in U.S crude stocks extended support to oil prices.

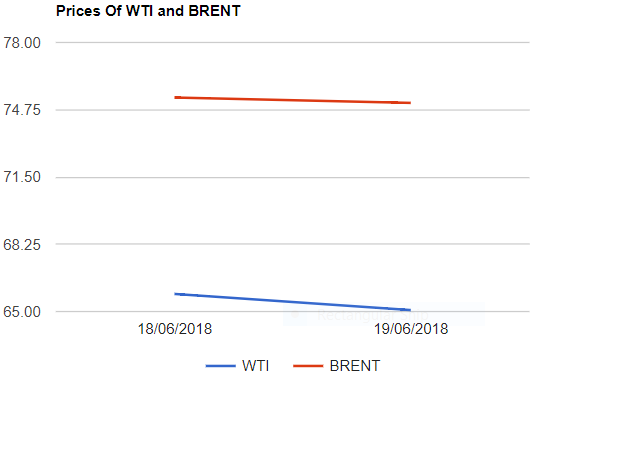

Crude oil prices update

Yesterday, U.S crude futures to be delivered in July lost 78 cents at $65.07 per barrel on Nymex while Brent August futures were down by 26 cents or 0.35 pct to close at $75.08 a barrel on London based ICE futures Europe exchange. Shanghai futures and MCX futures posted a loss of 0.7 and 1.38 pct respectively. Asian markets opened up today with a little change at the time of reporting.

API report – summary

The American Petroleum Institute, an Industry sponsored institute reported that U.S crude supplies fell by 3 Mb for the week ended June 15. The report also showed that a climb of 2.1Mb in gasoline supplies and 7.5Mb in distillates. EIA report is awaited and consensus is on fall in crude stocks.

Comment

Repeating message that oil markets are expected to be volatile till the OPEC and non-OPEC meeting during the week end.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com