By Srinivas Chowdary Sunkara // petrobazaar // 17th May, 2018.

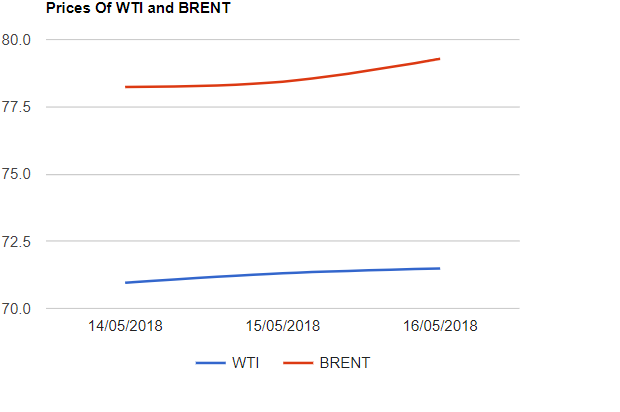

Brent is nearer to $80

Yesterday, Brent moved up by 0.85% while U.S crude increased by 0.18%. Markets are firm today in Asian trade and Brent is trading nearer to $80 per barrel. Strong dollar is limiting the further gains. U.S energy watch dog, EIA released bullish report in contrast with API report of building stocks. Markets find slight volatility over the EIA report.

IEA confirmed strong demand growth in 1Q18 and the start of 2Q18 followed by an expected slowdown in 2H18 due to higher oil prices. IEA reported that the robust non-OPEC output offset lower OPEC production. OPEC estimated demand growth in both OECD and non-OECD countries. Now Coming to reality, Markets are too far from fundamentals. We need to keep it in mind that 50% of the markets are driven by hedge funds which would be one of the reasons for massive fracture between physical and futures oil markets as reported.

Crude oil price update

U.S crude futures for June delivery gained 18 cents to close at $71.49 a barrel on Nymex while Brent futures to be delivered in July jumped by 85 cents at $79.28 per barrel on London based ICE futures Europe exchange. Asian markets are opened in positive territory and trading with little gains.

EIA report – Summary

U.S crude oil, gasoline and distillates stocks were reported to be down by 0.3 %,1.6 % and 0.1% respectively during the last week. U.S oil production was increased by 20 Kbpd at 10.723 Mbpd. Net imports and exports were increased during the week. Crude oil inputs into refinery were increased with an increase of 0.7% of refinery utilization. Stocks at major hub 'Cushing' were maintained at 37.2Mbpd.

Comment

Oil demand prospectus, Draws in U.S stocks and firmness in dollar movement are supporting the oil prices. U.S production growth, uncertainty on U.S sanctions on Iran are considered as threats. Prices are moving cautiously amid widening of spread between U.S crude and Brent.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com