By Srinivas Chowdary Sunkara // petrobazaar // May 14, 2018

Cautious trading:

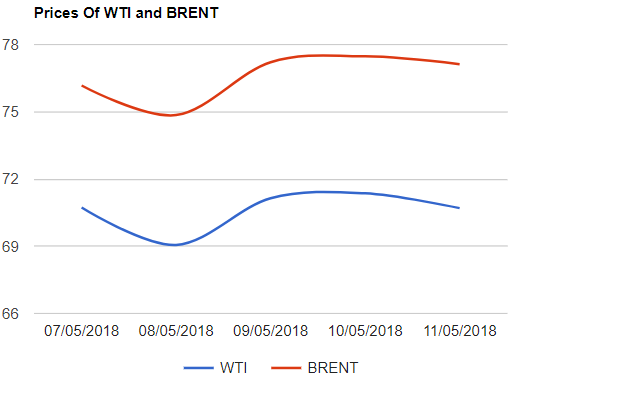

Friday's trading ended with a loss of less than 1%, however the futures gained 3.04% and 1.48% for Brent and WTI respectively during the week. This week brought us the confirmation of reimposing of U.S sanctions on Iran which was already priced and the futures reached fresh new high price levels after Nov, 2014. Europe back lashed U.S on sanctions on Iran and prepared to introduce measures to nullify the effect. Asia is not to drop trade relations with Iran. U.S drillers added 10 more rigs. IEA and OPEC estimated further demand growth for oil.

Crude oil price update

On Friday, U.S crude futures for June delivery lost 66 cents to close at $70.7 a barrel on Nymex while Brent futures to be delivered in July lowered by 35 cents to close at $77.12 per barrel on London based ICE futures Europe exchange. During the week, Shanghai futures were up 6.8% while MCX futures advanced Rs.125. Today Asian markets opened down amid cautious trading.

Rig count – Summary

Baker Hughes reported another increase in U.S rig numbers. Permian led the increase with 6 nos followed by Niobrara, Eagle Ford, Haynesville and Williston with 1nos each. Followed by an oil price rally for last two years, Rig numbers continued its row of increase. During the last week, Total rig numbers in North America reached 1118 Nos. Oil rigs were increased by 9Nos. from previous week and advanced with 131 nos from last year.

Comment

It seems that longs are preferred to book profits. Europe and Asia's stand on U.S sanctions on Iran along with an increased rig numbers created an uncertainty in the oil markets resulted in bearish trend. Monthly reports are expected to hint the market.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com