By Srinivas Chowdary Sunkara // petrobazaar // 13th June, 2018.

Oil prices fell

Yesterday, Oil prices edged up alongside of the global markets on Trump-Kim meeting, as Trump said that the meeting made a lot of progress and even more than expected. WTI settled higher before falling in post-settlement trading on API report of rising U.S crude inventories. Brent settled down as the investors prepared for OPEC+ meeting and outcome.

OPEC monthly report expected pronounced uncertainty in the second half of 2018 while reporting OPEC production was limited to below 32Mb/d in the month of May. IEA monthly report will be released today. EIA weekly stats are due and consensus is on falling U.S crude stocks by 2.6Mb.

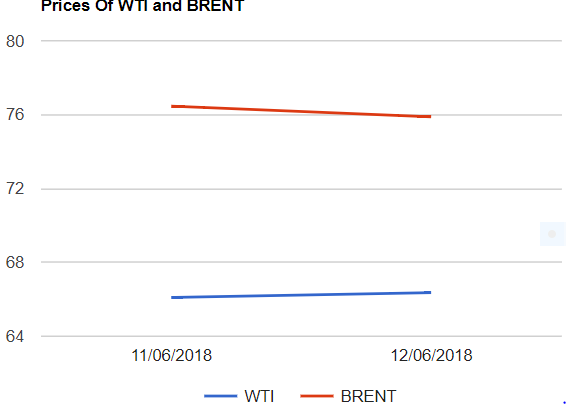

Crude oil price update

Yesterday, U.S crude futures for July delivery settled with a gain of 26 cents to close at $66.36 a barrel on Nymex where as Brent futures to be delivered in August posted a loss of 58 cents at $75.88 per barrel on London based ICE futures Europe exchange. Today, Asian markets are opened in bearish mood on the expected rise in U.S supplies.

API Report – summary

In U.S, Industry sponsored API reported that U.S crude supplies rose by 833K barrels for the week ended June, 8th. According to the report, Gasoline stocks were increased by 2.3Mb and distillates stocks were piled up by 2.1Mb. Analysts polled by S&P Global Platts expect that EIA will report a fall in crude stocks.

Comment

As reported by API, U.S crude stocks were accumulated due to a surge in U.S crude stocks to nearly 10.8 Mbpd despite of driving season. Saudi and Russia indicated to fill any supply gap by Iran and Venezuela. Strong dollar and Euro are pressing oil prices. EIA and IEA reports are expected to hint the markets.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com