By Srinivas Chowdary Sunkara // petrobazaar // 11th June, 2018.

Crude oil prices fell on rising drilling activity

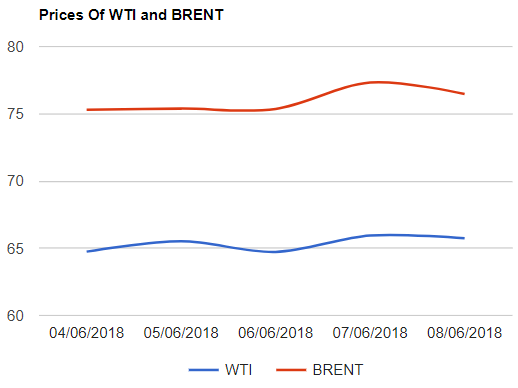

On Friday, Both the futures dipped and posted a weekly loss of below 0.5 Pct on mixed comments by OPEC and U.S. Last week opened with a bearish mood and continued throughout the week. Markets gauged the conflicting supply signals from OPEC and non-OPEC countries. Trade war fears and surprise U.S crude stocks build pressured the prices though API report extended some relief. Brent premium to WTI reached to record high $11 during the week.

Today Asian markets are opened down on rising drilling activity in U.S. Report of increase in Russians production in early June month also cause of concern. China's trade numbers and Japan's GDP depressed the market.

Crude oil price update

On Friday, U.S crude futures, WTI to be delivered in July dropped by 21 cents to close at $65.74 a barrel on Nymex where as Brent futures for August delivery booked a loss of 21 cents at $65.74 per barrel on London based ICE futures Europe exchange. Asian markets are opened down today.

Rig count – summary

Baker Hughes released weekly rig numbers on Friday. In U.S, Drilling activity increased slightly during week ending. Drillers added one oil rig and another gas rig into operations. Oil rigs numbers stood at 862, an increase of 121 from previous year. Permian basin added 3 numbers

where as Granite wash basin added one. Colorado, Louisiana added a combined three rigs, while Oklahoma and North Dakota and Wyoming lost a collective five.

Comment

Increased rig numbers indicate the boosting of U.S production which stood at 10.8Mb, very nearer to 11 Mb. Russia pushed up production to 11.1 Mbd in early June. China's depressed trade numbers signals lower oil demand. Money managers cut bullish Brent crude bets as reported by Bloomberg. Currently I am not convinced to be bullish on oil prices.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com