By Srinivas Chowdary Sunkara // petrobazaar // 6th June, 2018.

Market is gauging the weekly numbers

Yesterday, Both the futures closed up. U.S crude futures recovered from two month's lows and gained above 1 pct on the API report showing the shrinking of crude stocks in U.S. Brent was down most of the times during the yesterday's day trading on the reports of U.S asking OPEC to pump more oil. Investors are gauging the weekly production and stocks numbers ahead of scheduled OPEC meeting. Unless there is a significant change in the crude stocks to be reported by EIA, Prices will continue to move on the expected outcome of producer's meet, mostly volatile.

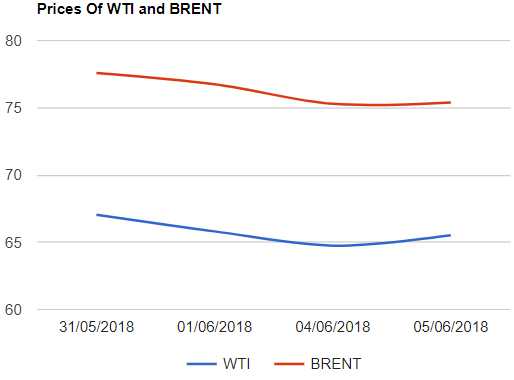

Crude price update

Yesterday, U.S crude futures for July delivery gained 77 cents to close at $65.52 a barrel on Nymex where as Brent futures to be delivered in August inched up 9 cents after touching one month low to close at $75.38 per barrel on London based ICE futures Europe exchange. Shanghai futures claimed narrow loss whereas MCX futures gained a little during volatile trading. Both the global futures opened up today during Asian trading hours.

API Report – summary

The industry sponsored American petroleum Institute released weekly report yesterday. The report said that the U.S crude supplies shrank by 2 Mb for the week ending June, 1st. This report also informed that the gasoline stockpiles rose nearly 3.8 Mb while distillates stocks were down by 8.71 Mb. EIA report is awaited and consensus is on drawings in U.S crude and gasoline stocks with a climb in distillates.

Comment

Markets are waiting for EIA weekly stats. I may be skeptical on OPEC decision of increase in production based on the facts that OPEC countries will raise production when oil prices are in peak high and there is no consensus on ups as some of the producers want high oil prices. Longs are away from the market and profit taking is continuing.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com