By Srinivas Chowdary Sunkara // petrobazaar // 3rd July, 2018.

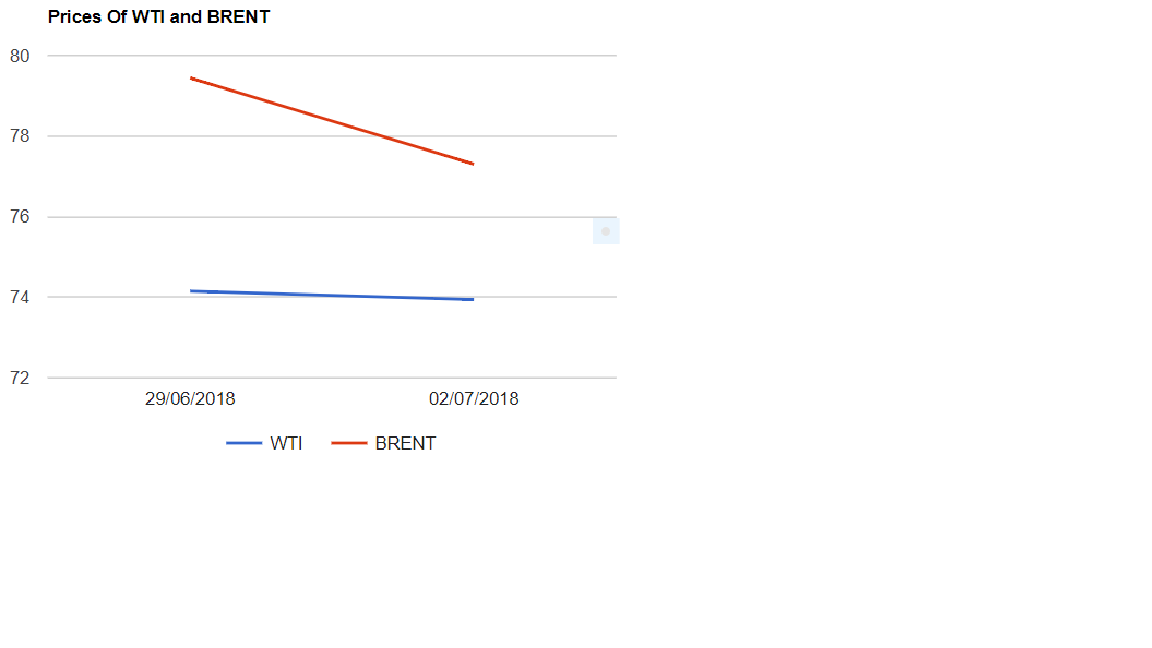

On Monday, Brent closed down $2.14 at $77.3 a barrel on ICE and U.S Oil slid by 21 cents at $73.94 per barrel on Nymex from its previous close. A flurry of announcements over the weekend unsettled oil markets after a weekly gains of above 5 pct.

Trump tweet on Saudi increasing production created a confusion across the market. Oil prices have been volatile for last couple of days on worries over the U.S sanctions could remove a significant quantity of oil from the market. Reuter's survey showed that Saudi and Russia increased output from May and falling Asia's demand growth due to ongoing trade tariff wars are the factors behind yesterday's price fall. How much oil Saudi is going to increase, trade tariff issue and Sanctions on Iran are the dynamics expected to be decisive for now.

Today, Asian markets are opened up after Libya announced force majeure on significant quantity of exports from eastern fields and ports. Rising OPEC production and significant slow down in Asia's demand growth weigh on oil prices.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com