By Srinivas Chowdary Sunkara // petrobazaar // 1st August, 2018.

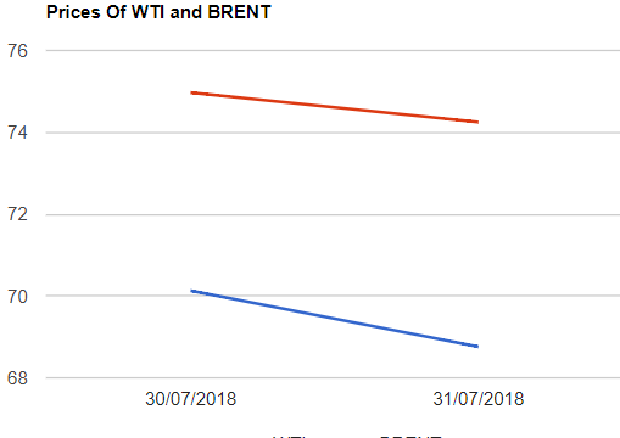

Brent was down by $0.72 at $74.25 and WTI closed down last night by 2 pct at $68.76. Both the futures posted a largest monthly decline in two years. Traders preferred to sell off after a survey reported that the OPEC increased supplies in July and reached high for the year. Market responded to the state of 'less tight' in July as the global balance of supply and demand softened.

The aggressive tweets in CAPITAL LETTERS softened with meeting proposal to curtail price volatility. Every body knows that Tehran will not accept and is further claiming that Saudi can not compensate Iranian oil after sanctions. API surprised everybody after reporting a rise in U.S crude supplies. EIA will confirm tomorrow and consensus is on fall of 2.4Mb of crude. Oil prices are trading down today in Asian markets.

Today morning, I was reading about 'prompt demand' in oil industry. I fear how come Industry meet 'prompt demand' in future. As per the latest report, Oil industry has cut down upstream expenditure drastically after 2014. In spite of double and triple earnings in 2018, Investments are not getting floated into new discoveries. Is upstream companies are really concerned about the climate change and forth coming taxes. if so, Major oil and gas reserves will remain in ground and will add to price. Major consumers like India are not happy with higher oil prices. IEA also warned recently on low investments in to oil fields. Let us think. Good day.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com