By Srinivas Chowdary Sunkara // petrobazaar // 1st June 2018.

Oil prices are volatile

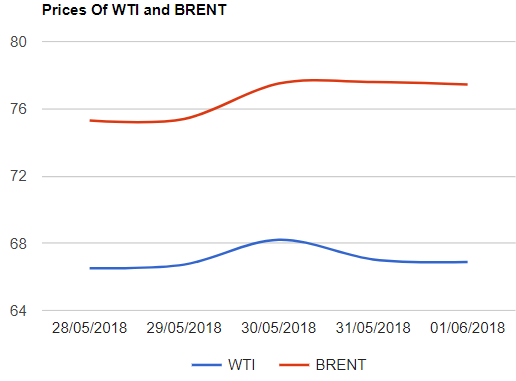

Yesterday, Brent closed up with a little change while U.S crude prices were under pressure. U.S record level of high production numbers and exports overshadowed the drawings in crude stocks during the week ending with 25th May. The spread is widened to new highs after 2015 and buyers want to take advantage of low priced WTI. Cheaper American crude grades headed from U.S.Gulf coast to Asia. Markets have reacted quite considerably to the news of the top producers are turning back to increase production and rebounded to the reports of continuing adherence of production cut agreement till the end. Investors are looking for cues.

Crude oil prices update

Yesterday, U.S crude futures for July delivery dropped by $1.17 or 1.72% to close at $67.04 a barrel on NYMEX. Brent July futures were expired yesterday and August futures edged up 9 cents at $77.59 per barrel on London based ICE futures Europe exchange. Shanghai futures were moved up a little where as MCX June futures picked up by 6.84%. Today Oil prices are opened down during Asian hours.

EIA report – Summary

U.S commercial crude oil inventories were down by 3.6Mbpd where as Gasoline and distillates inventories were built by 0.5Mbpd and 0.6Mbpd respectively. Crude production continued to boost up to new high levels at 10.769 Mbpd. Import were narrowed and exports were widened during the week. Crude oil inputs putting into utilization were increased by 527Kbpd with utilization of percentage at 93.9, an increase of 2.1% . Cushing stocks were drawn by 0.6Mb.

Comment

Markets are more focused on producer's meetings and statements. I strongly feel that fundamentals are still there and are going drive the price movement. Venezuela lost 500K production and expected to lose another 500K. Iran will leave with 2.6Mbpd after U.S sanctions. Libya's production is another concern. Global demand is growing by 1.8Mbpd, needs to be compensated gradually. Currently, oil prices are more sensitive to supplies headlines.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com