By Srinivas Chowdary Sunkara // petrobazaar // 9th June, 2020.

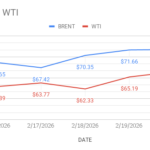

Brent oil prices for August delivery edged down $1.5 or 3.55% to $40.8 on London based ICE futures Europe exchange. WTI July oil futures traded down $1.36 or 3.44% to $38.19 a barrel on Nymex. In Shanghai, crude oil main contract futures rose by 13.5 Yuan or 4.78% at 295.7 Yuan/barrel. MCX crude oil futures for June delivery traded closed Rs.108 down at Rs.2882 per bbl. Brent premium over WTI narrowed down to $2.61 during yesterday's session.

The world crude oil prices indexes demonstrated upside momentum today over the optimism amid growing demand since pandemic lockdowns easing. Yesterday, Both the benchmark futures traded down erasing the previous session's strong gains after Saudi said that KSA and its allies, Kuwait and the UAE would not extend an additional 1.18 Mpbd in cuts on top of the OPEC+ cuts in July. Product demand is estimated to restore post lock down ease. New York City began reopening and life is returning normal which may spur some product demand. Analysts estimate fall in U.S crude and gasoline stocks while distillates stocks will be build up last week. The price rally and inventory over hand are two challenges for OPEC+, threatening the sustainability of both the price recovery and its market share. OPEC hopes to tighten near term balances and push spot prices higher than forward prices, encouraging inventory draws.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com