By Srinivas Chowdary Sunkara // petrobazaar // 9th May, 2019.

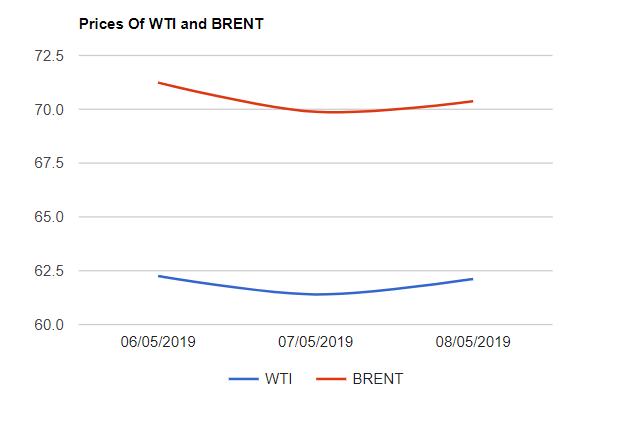

Brent prices inched 49 cents up to $70.37 and WTI prices edged 72 cents up to $62.12 a barrel last night. Shanghai crude oil futures dropped by 0.2 Yuan or 0.04% to 482.3 Yuan/barrel while MCX crude futures jumped Rs.70 to Rs.4334 yesterday. Oil prices were under pressure after a total of 102 words of tweet that erased $1.36 trillion from global stocks this week. EIA report of surprise draw in U.S crude stocks arrested a major fall in oil prices yesterday.

Analysts says that the investors are lightening their positions as a 'precaution' ahead of proposed U.S fresh tariffs on China goods this week. I don't think that U.S – China trade war doesn't matter any more as trade disputes damage has already been done and investor should come out of medium consequences of 'Offs' and 'Ons' of tariff fixation. Investors seems to be taking excuse to book profits in the name of 'trade war'.

Turning to weekly report, Crude and product stocks were drawn in U.S during the last week and production was trimmed at 12.1Mbpd. Refinery inputs and utilisation numbers were on downside as the refineries are geared up for maintenance season to prepare their equipment for the upcoming IMO 2020 emission rules that will suspend the production high sulphur fuels in favor of low sulphur fuels. Asian markets are trading in red at the time writing. Have a good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com