By Srinivas Chowdary Sunkara // petrobazaar // 31st March 2020.

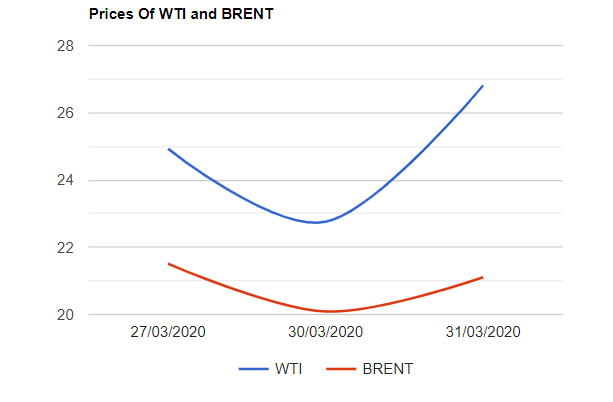

Brent oil prices for May delivery closed $2.17 lower to $22.76 on London based ICE futures Europe exchange. WTI oil futures prices to be delivered in May settled $1.42 down at $20.09 a barrel last night. In Shanghai, Crude oil main contract futures prices dropped by 4.9 Yuan or -1.91% to 252 Yuan/barrel while MCX crude oil April month futures slipped Rs.83 to settle at Rs.1616 a barrel yesterday. Brent premium over WTI narrowed down to $2.67 a barrel during the session.

The world crude oil price indexes rebounded today morning and trading above 5% up as the Chinese official Purchasing Manager's Index for March was 52, beating expectations for an economy hit by the coronavirus outbreak. U.S president Trump's phone call negotiations with Russia's counterpart to pull up the chair to the negotiation table with Saudi showed a signal to support oil prices. A report of containing virus in Italy as no news cases were reported and WHO report of recovery in Europe are the other factors contributed to the oil complex. Analysts estimate that Brent prices will reach $30 to $40 levels in the second quarter of 2020 based on the developments in April. API numbers are due later today. Any signs of Saudi and Russia coming together to prop up oil prices will be positive factor for oil prices during the week.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com