By Srinivas Chowdary Sunkara // petrobazaar // 31st July, 2019.

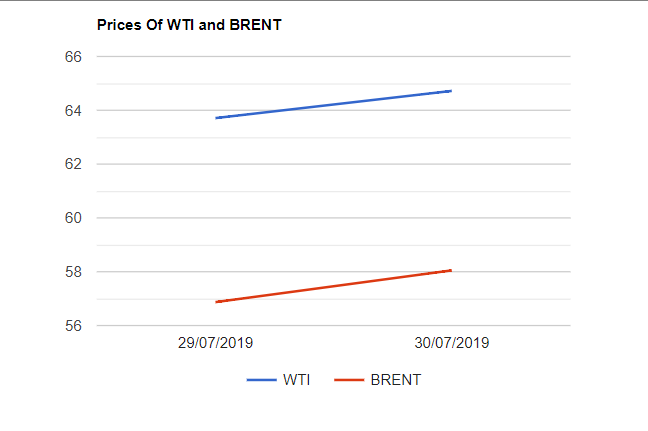

Brent oil prices for Sep delivery rose $1.01 to $64.72 and WTI Sep futures prices climbed $1.18 to $58.05 a barrel last night. Shanghai crude oil main contract futures prices went up by 2.6 Yuan or 0.59% to 444.1 Yuan/barrel while MCX crude futures settled Rs.182 up at Rs.3987 yesterday.

The world crude oil benchmark futures continued upward trend for the fourth day to its highest after July 15th but set to lose 1-2% for the month. As i mentioned in my earlier comment, Optimism over fed rate and expected meaningful drawings in U.S stocks for the straight 7th week driving the oil price. Supply risks through Straight of Hormuz waters still a concern, continued to support oil complex. Turning to weekly data, API reported that U.S crude oil inventories are drawn 6.024Mb for the week ending July, 25th. EIA will confirm the numbers later today. On the supply side, Analysts are in the opinion that OPEC could roll over its production cut pact until the end of 2020 as the demand from the top oil consuming countries like U.S, China and India continue to slow. Coming to trade talks, U.S and Chinese negotiators will meet this week for their first in-person talks however expectations for progress are low. Today, oil indexes continued slight upward evolution during the Asian hours. To me, current upward momentum seems to be temporary and can not be sustained. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com