By Srinivas Chowdary Sunkara // petrobazaar // 30th March 2020

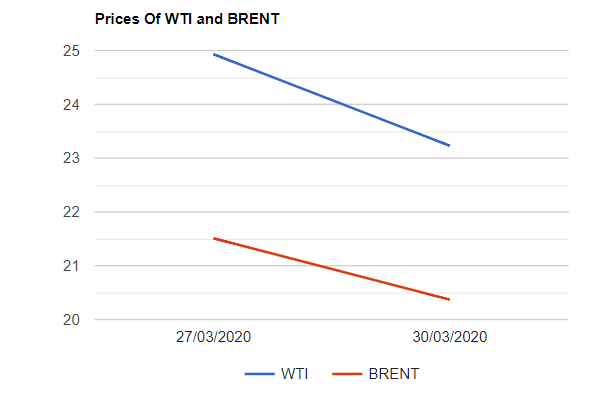

Today, Brent oil futures for May delivery trading low at $22.8 , Slipped $2.13 or 8.544% from opening price while WTI oil prices to be delivered in May sank $1.29 or 5.997% at $20.22 today. Both the benchmark crude oil futures prices settled 5% lower on late week logged in fifth straight weekly loss. In Shanghai, crude oil main contract futures prices decreased by 5.9 Yuan or -2.26% at 255.6 Yuan/barrel while MCX crude oil April month futures prices settled Rs.88 lower at Rs.1699 a barrel on Friday. Brent traded at a premium of $3.42 over WTI during the session.

The world crude oil benchmark futures prices have been slammed by the continued demand destruction caused by the coronavirus pandemic across the market. Markets ran out of ammunition to support the market as the both the spearheads of OPEC and non-OPEC groups are expected to start flooding the cheap oil into market. Analysts are in the opinion that the global storage tanks will be filled with the cheap oil in the coming days and that will have all sorts of disruptive impact on pricing. With estimated plunge of 10 million to 20 million barrels of demand per day in the coming month, massive production cuts are need to prop up oil prices. The contango spread between May and November brent oil futures widened at $13.45 a barrel. Oil companies began to respond to the crash by limiting CAPEX, but cutting drilling operations and CAPEX is not enough.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com