By Srinivas Chowdary Sunkara // petrobazaar // 29th March, 2019.

Brent lost one cent to $67.82 and WTI futures dropped 11 cents to $59.3 a barrel last night. Shanghai crude oil main contract closed 1.24% down at 453.2 Yuan/barrel while MCX crude futures in India settled Rs.24 up at Rs.4143 yesterday. Both the global crude markers touched session lows after Trump tweet on OPEC supplies but subsequently rallied above pre-tweet levels as the market could not find novelty in latest tweet. It seems that U.S president's tweets are losing price significance.

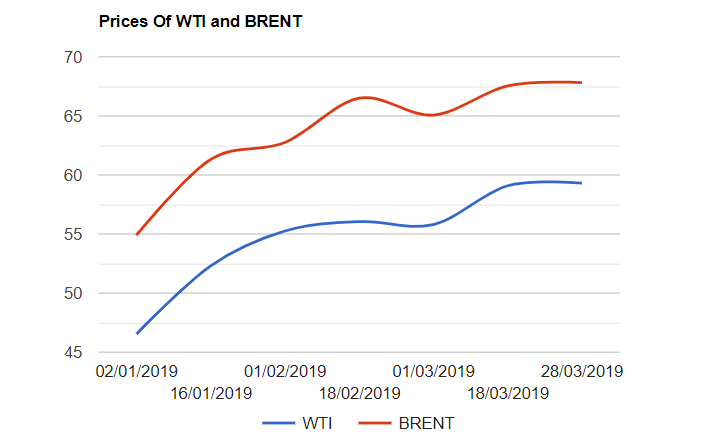

Finally, We are at the end of first quarter and both the benchmarks are heading for around 25% up, The best quarterly gains since 2009. Turning to weekly data, U.S rig numbers are awaited today. Today, Asian markets are opened up on positive news across the market and crude is set to close the week high. Good day and happy week end.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com