By Srinivas Chowdary Sunkara // petrobazaar // 28th January 2020.

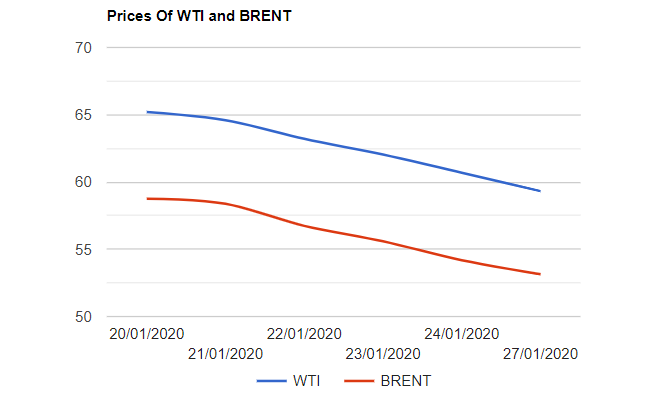

Brent oil futures prices to be delivered in March dropped $1.37 or 2.3% to $59.32 while U.S crude oil futures for March delivery settled down $1.05 or 1.9% at $53.14 a barrel last night. In Shanghai, crude oil futures prices remained at 447.2 Yuan/barrel while MCX crude oil futures prices closed Rs.90 lower at Rs.3783 yesterday. The Brent benchmark traded at a premium of $6.18 over WTI during the session.

The world crude oil price indexes turned down yesterday on concern of increasing death toll from China's corona virus grew, Curtailing travel that would potentially reduce the demand for fuels, Especially Jet fuel. The global stock markets, which, Oil markets follow very often also sank on ongoing crisis. On the other hand, The producer's group tried to play down the impact of 'virus' on crude prices and felt confident that the new 'virus' could be contained very soon. However, Riyath, the de-facto leader of OPEC said that the group could respond to any changes in demand. Turning to data side, API estimates are expected later today.

Today morning, Oil indexes continued to be on downside during the Asian hours and the trend do not indicate any firm trend so far. I do not see any clue so far which would contain further slip in the global oil prices. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com