By Srinivas Chowdary Sunkara // petrobazaar // 27th Dec 2019.

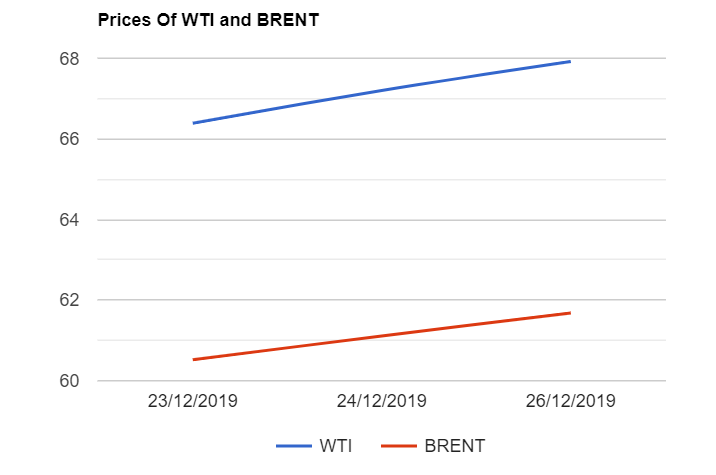

Brent oil futures prices gained 72 cents to $67.92 and WTI oil futures prices advanced 57 cents to $61.68 a barrel last night. In Shanghai, Crude oil main contract futures prices rose by 1.5 Yuan or 0.31% to 484.8 Yuan/barrel where as MCX crude futures settled Rs.47 up at Rs.4403 yesterday. Brent premium over WTI widened to $6.24 during the session.

The world crude oil price indexes moved about 1% up to the highest in more than three months on Thursday. The rally was boosted by hopes of ending U.S – China trade fight coupled with bullish weekly reports. Crude markets were also supported by fresh highs in the equity market which often support oil complex. On the supply side, SA and Kuwait finally settled the desert dispute and agreed to resume oil production from the joints fields in the neutral zone which might add 500,000 bbl/day in the new year apart from Guyana's entry to pump oil. Turning to weekly data, API estimates showed a hefty drawings in U.S crude inventories by 7.9M while product stocks are estimated to build during the last week. U.S government weekly numbers are delayed by two days due to Christmas and due to released today, Consensus is on 1.83Mb draws.

Today morning, Asian markets opened in green and it does not demonstrate any firm trend so far. Weekly data may spur volatility in the oil market today. Oil prices are showing year end strength coupled with prospectus of U.S – China trade deal, OPEC+ propping up cuts along with the reduced shale activity. Brent gained around 25% during the year. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com