By Srinivas Chowdary Sunkara // petrobazaar // 27th April, 2022.

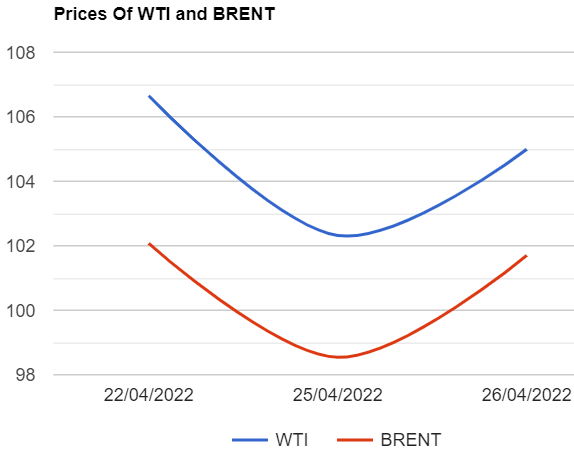

Brent oil futures prices for June delivery rose $2.67 or 2.61 pct to close at $104.99 a barrel on London based ICE futures Europe exchange while U.S crude oil June month futures prices gone $3.16 or 3.21% up to settle at $101.7 a barrel last night. In Shanghai, Crude oil main contract futures prices went up 6.9 yuan to 642.1 Yuan/bbl whereas MCX crude oil front month futures prices ballooned Rs.424 or 5.69 pct up to Rs.7880 a barrel yesterday. Brent premium over WTI narrowed down to $3.29 a barrel during the session.

The world crude oil price index curves bounced back after a hefty fall in the previous session following the last week's loss. Both the benchmarks moved up in a choppy trading as the traders are in a mood to take another break since it is too muddy to trade at this point of time. Markets are in mixed mood since gloomy economic outlook, Continuing mass virus tests in China, Strong dollar and war fears are prevailed to curtail demand going forward. On the other hand, Exploding refinery margins and China's plans to support economy against a possible coronavirus lockdown in its capital keep flour for oil prices. Turning to weekly reports, API predicted a build in U.S crude and distillates by 4.787Mbpd and 0.431Mbpd respectively while gasoline stocks are estimated to be drawn by 3.911Mbpd while Cushing stocks were piled up by 1.143Mbpd as per report. Consensus is on stock build during the last week. EIA will confirm numbers later today. Today, Asian markets opened in green zone and markets are expected to trade flat.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com