By Srinivas Chowdary Sunkara // petrobazaar // 27th January, 2021.

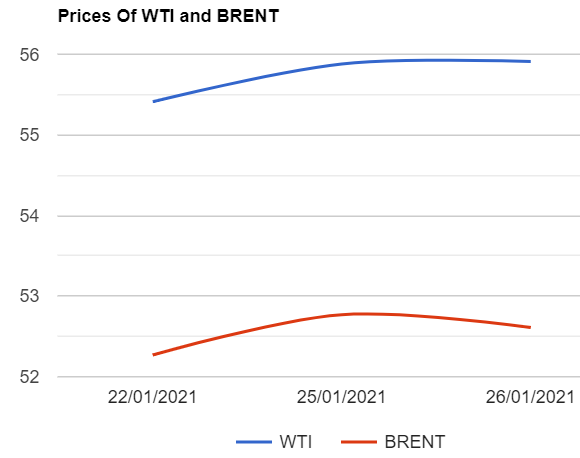

Brent oil for March settlement inched up 3 cents or 0.05% to $55.91 a barrel on London based ICE futures Europe exchange and WTI oil futures to be delivered in March dropped 16 cents or 0.3% to $52.61 a barrel on NYMEX. In Shanghai, Crude oil main contract futures prices sank 3.7 Yuan or -1.12 pct at 328 Yuan/barrel while MCX crude oil current month futures were not traded due to Republic-day holiday in India. Brent premium over WTI narrowed down to $3.3 during the session.

The world crude oil price indices moved irregular yesterday amid surge in virus cases that flared demand fears while losses were capped on reports of a blast in Saudi Arabia. IMF prediction of global growth of 5.5% in 2021, OPEC strong compliance of above 85% with pledged output, Expecting more stimulus in U.S and ongoing geo-political tensions are the other bullish factors that support oil complex. Turning to weekly report, API reported a decline of 5.3 Mb while gasoline and distillates stocks were expected to built up by 3.1Mb and 1.4Mb respectively for the week ending 22nd Jan. EIA will confirm the numbers today and consensus is on crude draw with build in product stocks. Today, Asian markets opened in green and it doesn't demonstrate any firm trend so far.

Mr.Barkindo said that worst is over for the global oil markets, oil backwardation shows 2021 will be a positive year. Is it possible with a billion sick people and millions of deaths? and I mention Chris cook comment 'backwardation shows nothing other than that some one is paying more for spot futures than some else is paying forward'.

Good day to all.