By Srinivas Chowdary Sunkara // petrobazaar // 26th August, 2021.

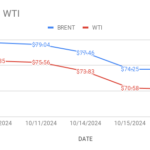

Brent oil futures prices for Sep delivery rose $1.2 or 1.69 pct to settle at $72.25 a barrel on London based ICE futures Europe exchange. WTI oil futures to be delivered in Sep advanced 82 cents to close at $68.36 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 6.9 yuan to 429.5 Yuan/bbl while MCX crude oil front month futures prices edged up Rs.30 to Rs.5054 a barrel yesterday. Brent premium over WTI further widened to $3.89 a barrel during yesterday's session.

The world crude oil price index curves continued to hover for the third day in a row after the benchmark prices snapped the seven-day losing streak last week. Mexico outage that caused a loss of 400Kbpd, Bullish weekly numbers and easing of Delta variant spread in China boosted the prevailed positive sentiment across the market. Turning to weekly numbers, EIA reported that U.S crude and gasoline stocks were drawn by 3Mbpd and 2.2Mbpd respectively while distillates stocks were built up moderately by 0.6Mbpd last week. U.S production numbers remained unchanged while export numbers outweighed import numbers that would be one of reason for drawings. Increased crude throughput into refineries along with surge in utilisation percentage is an indication of bright demand outlook that reflected in gasoline numbers. Stocks at Cushing also went down. Analysts expect that volatility set to continue to see further gains in crude prices since global economic normalization continues and OPEC remains disciplined on crude supplies. Asian markets opened in bearish mood today, Taking back some of the gains in the previous sessions. Rig numbers are due later today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com