By Srinivas Chowdary Sunkara // petrobazaar // 25th August, 2022.

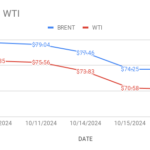

Brent Oil Oct futures prices rose $1 or 1 pct to $101.22 a barrel on London based ICE futures Europe exchange while WTI oil futures prices for Sep delivery went up $1.15 or 1.23 pct to close at $94.89 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices surged 21.3 Yuan to 734.1 Yuan/bbl where as MCX crude oil front month futures prices soared to Rs.7559 a barrel yesterday. Brent premium over WTI widened up to $6.33 a barrel during the session.

The world crude oil price index curves continued to demonstrate upside momentum for second straight day amid volatile trading. U.S will not consider additional concessions to Iran in its response to a draft agreement that would restore Tehran's nuclear deal and KSA suggested that OPEC countries can consider to tighten supplies incase of additional supplies from Iran to protect prices are the fundamental factors that supported oil complex. U.S weekly stock report also supported bullish mood in the market after EIA report of drawing in crude and distillate stocks although gasoline numbers flagged lackluster demand outlook that limited rally. Bearish economic signals from central bankers and falling equities continued to weigh on oil prices. Today, Asian markets opened in green, Adding to yesterday's gains. Rig numbers and CFTC numbers are awaited and markets are set to close the week with gains.

Good day to all

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com