By Srinivas Chowdary Sunkara // petrobazaar // 25th January, 2019.

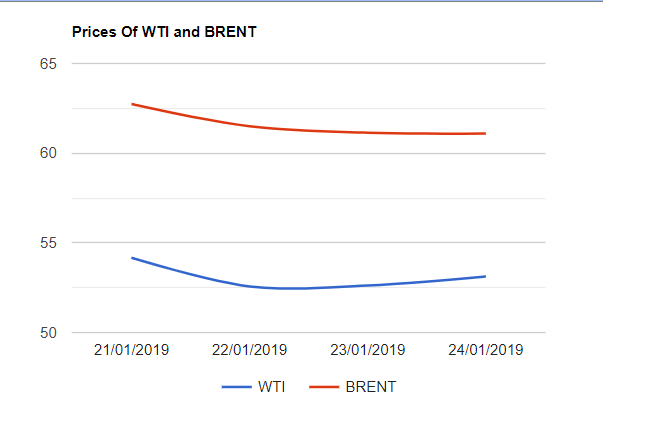

Brent futures inched down by 5 cents to settle at $61.09 and WTI futures rose 51 cents to close at $53.13 a barrel last night. The spread is narrowed down to $7.96 during the yesterday's session. The U.S threatening Venezuela with fresh sanctions, Supported U.S oil prices. The bearish weekly stock report by EIA limited the WTI gains. The government agency reported a piling up of crude and gasoline stocks for the straight 8th week. The anemic world economy, Concern of oversupplies continued to weigh on Brent prices.

The Washington seems to be targeted another OPEC supplier after Iran. While Iran is already been crippled by sanctions, A drop in Venezuela exports will squeeze global supplies further. U.S should look for alternative suppliers for heavy crude supplies while Caracas will look at India and China and other major importers to compensate exports to U.S. Trump ratcheting up with fresh sanctions will create some volatility in the coming days. Bakers Hughes weekly drilling report is awaited today. Asian markets are opened up today. Good day and happy weekend.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com