By Srinivas Chowdary Sunkara // petrobazaar // 24th Dec, 2020.

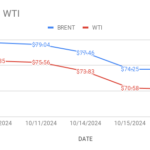

Brent oil futures for Feb delivery rose $1.12 or 2.24% to $51.2 a barrel on London based ICE futures Europe exchange. WTI oil Feb futures prices went up $1.1 or 2.34 pct to close at $48.12 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slipped 3.8 Yuan to 291.4 Yuan/bbl while MCX crude oil current month futures prices closed up Rs.85 to settle at Rs.3568 a barrel yesterday. Brent premium over WTI widened further to $3.08 a barrel during the session.

The world crude oil price indices went up more than 2% on report of U.S stock draws. Potential Brexit deal what weighed on a green back and expected supply disruptions in Nigeria are the factors that helped crude complex. Lingering worries over weaker demand outlook due to fast spreading contagious news variant of virus capped margins. Turning to weekly data, EIA reported that U.S commercial crude oil inventories were down by 0.6Mb, Total gasoline stocks were decreased by 1.1Mb while distillates stocks were down by 2.3Mb last week. U.S crude oil imports were up by 140Kbpd. Refineries operated at 78% of their operable capacity while crude oil refinery inputs averaged 14 Mbpd during the week ending Dec 18th 2020. Today, Oil futures extended gains in Asia and it seems traders are quiet on the eve of Christmas.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com