By Srinivas Chowdary Sunkara // petrobazaar // 24th July, 2021.

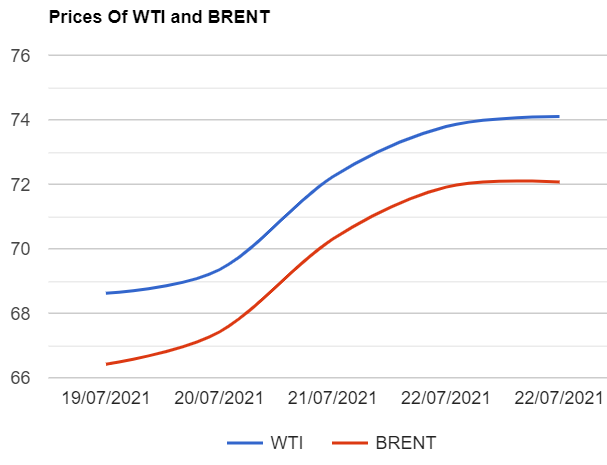

Brent oil futures for Sep delivery advanced 31 cents or 0.42 pct to close at $74.1 a barrel on London based ICE futures Europe exchange. WTI oil futures for Sep delivery rose 16 cents or 0.22% to settle at $72.07 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices edged up 10.2 Yuan/bbl to 436.6 Yuan//bbl while MCX front month contract futures prices closed Rs.16 up to Rs.5369 a barrel yesterday. Brent premium over WTI widened up to $2.03 during the session.

The world crude oil price index curves continued to move up on bull market intact and ref margins, but not a straight line up. Oil along with other riskier assets markets tumbled at the start of the week on demand concerns from surging Delta-virus cases in U.S , Britain and Japan. Both the benchmark prices recouped later on reports that demand will outstrip supply during the year. Surprised bearish weekly numbers also could not weigh on oil price momentum as markets believed that demand concerns proved to be exaggerated. Both the benchmarks logged in weekly gains.

As per CFTC data, Money managers reduced their net-length in WTI crude oil futures and options by 64702 to 316,789 in the week ending July 20. Long-only positions fell by 56,793. Short-only positions rose by 7,909. Ref to ICE weekly data, Money managers reduced their net-length in Brent crude oil futures and options by 50,786 contracts to 261,841 in the week ending July 20. Long only positions fell by 58,374 and Short-only positions fell by 7,588.

Happy week end and good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com