By Srinivas Chowdary Sunkara // petrobazaar // 24th March, 2021.

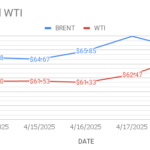

Brent oil futures prices for May delivery shed $3.83 or 5.93 pct to settle at $60.79 on London based ICE futures Europe exchange. U.S crude benchmark, WTI oil May futures prices plunged $3.79 or 6.16% to close at $57.76 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices inched up 0.7Yuan to 390.8 Yuan/bbl while MCX crude oil current month futures prices nosedived Rs.243 to settle at Rs.4237 a barrel yesterday. Brent premium over WTI further narrowed down to $3.03 a barrel during the session.

The world crude oil price index curves descended yesterday on virus worries, New lock down concerns and strong dollar, Fundamentally. Weakening of physical markets pushed brent spread into little contango at the short end of the futures curve. Technically speaking, the futures markets were already looking very overheated by the end of February and start of March, Creating ideal conditions for a sharp retreat as per Kemp. Futures prices are anticipating strong demand recovery, Starting late in the second quarter and early in the third, as well as continued production restraint by OPEC+ and U.S shale firms. Hedge funds and other money managers stopped buying extra crude futures and options. In this context, adverse news about the virus and infections weighed on oil prices. Port folio manager's profit taking also exaggerated the situation.

Turning to weekly reports, API estimated that U.S crude stock piled up 2.9 Mb while gasoline stocks are drawn by 3.7Mb where as distillates stocks rose by 246Kb. EIA will confirm the numbers later today. Consensus is on draws. Asian markets extended yesterday's losses. Weekly reports likely to strengthen bearish sentiment in the market.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com