By Srinivas Chowdary Sunkara // petrobazaar // 23rd Oct, 2019.

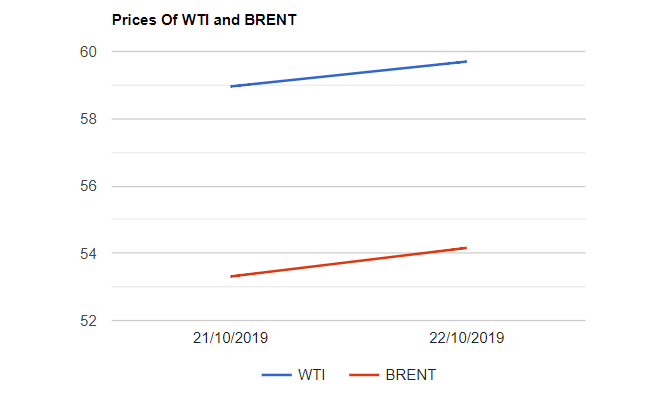

Brent oil prices rose 74 cents to $59.7 and WTI oil futures gained 85 cents to $53.16 a barrel last night. In Shanghai, Crude oil main contract futures fell by 4 Yuan or 0.9% to 442.3 Yuan/barrel while MCX crude Nov futures closed Rs.45 up at Rs.3855 yesterday. Brent premium narrowed a little at $5.54 to WTI.

The world oil price index moved a little up yesterday buoyed by rumors on possible resolution in Dec meet to continue to rein in supplies by OPEC+ group. China's signaling progress in trade talks supported oil complex while gains were muted by bearish inventory data forecasts. Turning to weekly data, API report came out late Tuesday and showed that U.S crude supplies are built by 4.45Mb while product stocks are drawn for the week ended Oct 18th. U.S government data will confirm the numbers later today. The consensus is on build in crude stocks. On supply side news, Russian Energy Minister, Alexander Novak said that U.S oil production is likely to peak in the next few years. More production, More pressure on oil prices, less drilling, less employment will eventually falter fuel demand. Analysts see downward arc of the upward swing that began in 2016.

Today morning, Oil markets opened with bearish mood during Asian hours and it does not demonstrate any firm trend so far. I expect markets will bet on bearish weekly data. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com