By Srinivas Chowdary Sunkara // petrobazaar // 22nd Oct, 2021.

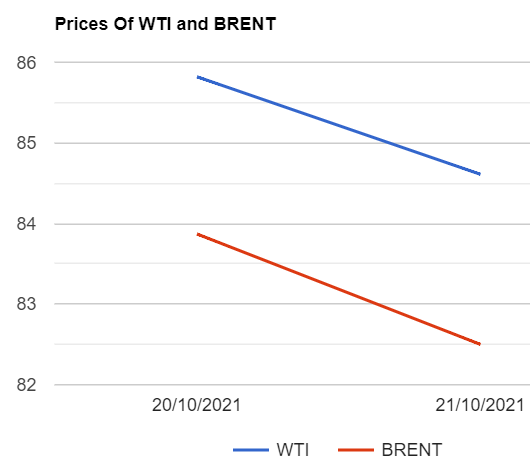

Brent oil Dec futures prices dived $1.21 or 1.41 pct to settle at $84.61 a barrel on London based ICE futures Europe exchange. U.S crude oil futures, WTI to be settled in Dec closed $1.37 or 1.63% lower at $82.5 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 5.4 Yuan to 529.8Yuan/bbl while MCX crude oil front month futures prices tumbled Rs.77 to settle at Rs.6146 a barrel yesterday. Brent premium over WTI widened to $2.11 a barrel during the session.

The world crude oil price index curves turned down on warm U.S winter report. Brent touched three-year's high above $86 in the early session on tight supply amid global energy crunch. Both the benchmark Prices started go down after a report indicated drier and warmer conditions across the sourthern and eastern U.S that pressed oil complex. On the supply side, U.S main storage hub, Cushing, Once again set to play a key role after pushing WTI prices into negative territory during the pandemic time due to overflow of crude at that time. Analysts warn that the key storage facility is going to dry in a weeks time. Energy crisis in Europe and Asia reaching alarming levels, Will push oil demand up. OPEC+ group's over compliance rate to its output cuts also will contribute to price rally in near future as per analysts. Putin also warned shortage of oil in near term. On the data side, Baker Hughes numbers are due later today. Today, Asian markets are opened in red, adding to yesterday loss.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com