By Srinivas Chowdary Sunkara // petrobazaar // 22nd Sep, 2021.

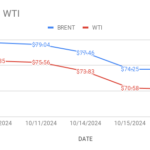

Brent oil Nov futures prices rose 44 cents or 0.6 pct to $74.36 a barrel on London based ICE futures Europe exchange. WTI oil futures to be delivered in Oct edged up 27 cents or 0.38 % to close at $70.56 a barrel on NYMEX last night. WTI Oct futures expired yesterday and the most active Nov futures prices gained $1.01 a barrel to $71.15 a barrel. In Shanghai, Crude oil main contract futures prices remained unchanged at 474.6 Yuan/bbl while MCX front month futures prices little changed to Rs.5207 a barrel yesterday. Brent premium over WTI widened to $3.8 during the session.

The world crude oil price index curves turned positive after markets slammed in the previous session. Both the benchmark prices were propped up as the oil markets are grappled with supply concerns. About 18% of the U.S Gulf's oil remained offline and rise in producers group compliance rate to 116% in August shifted focus from turmoil of the stocks markets sparked by Chinese heavily indebted property group, China Evergrade. Putting some light on weekly numbers, API numbers are out and it reads hefty drawings in U.S crude stocks by 6.108Mbpd. Gasoline and Distillates are estimated to slipped by 0.432Mbpd and 2.72Mbpd as per data. EIA will confirm numbers later today and consensus is on drawings. Asian markets are opened in green and trading high at the time of reporting. I see bulls momentum this week.

Good day to all

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com