By Srinivas Chowdary Sunkara // petrobazaar // 21st Oct, 2021.

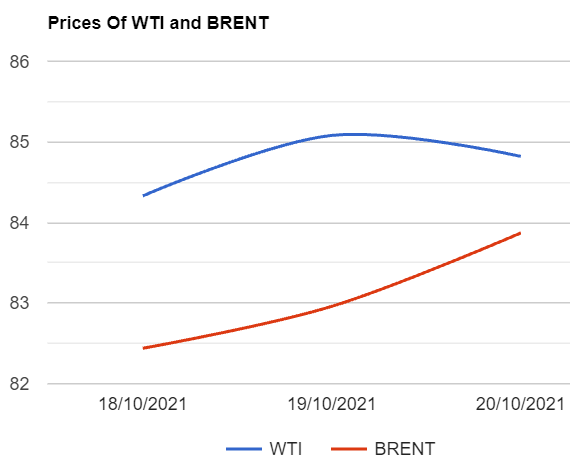

Brent oil Dec futures prices rose 74 cents or 0.87 pct to settle at $85.82 a barrel on London based ICE futures Europe exchange. WTI oil futures prices for Nov delivery advanced 91 cents or 1.1 % to close at $83.87 a barrel on NYMEX last night. U.S crude Nov futures contract expired yesterday. In Shanghai, Crude oil main contract futures prices inched down 6 Yuan to 524.4Yuan/bbl while MCX front month futures prices moved steadily yesterday. Brent premium over WTI narrowed down to $1.96 during yesterday's trading.

The world crude oil price index curves moved up after a downturn in the early trading yesterday. Both the benchmarks moved down in the early trading on API estimation of U.S stocks build last week . Later on, Markets rebounded on EIA confirmation of stock draws last week across U.S markets that clawed back some of the early losses. On the supply side, The world's third largest oil consumer, India wanted oil producing countries to consider supplies on long-term contracts at fixed prices to reduce burden on ex-chequer. India imported 3.9Mbpd of crude and condensates last month, Observed that oil import costs rose sharply on the back of higher crude oil prices. As per IEA, India's oil demand will rise to 7.1Mbpd by 2030 from 5.3Mbpd in 2019, Leading to net dependence on imports of 91 pct by 2030. Turning to weekly data, Trouncing back analysts expectations, EIA reported that crude stocks fell by 400000 bpd while gasoline and distillated were drawn by 5.4Mbpd and 3.9Mbpd respectively. U.S crude production ramped up, Imports numbers sank while exports were boosted up. Crude throughput was down along with slow down in refinery utilisation might have contributed to uptick in crude stocks during the last week. Today, Asian Markets are opened mix. Markets are waiting for directions in my view.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com