By Srinivas Chowdary Sunkara // petrobazaar // 21st April, 2022.

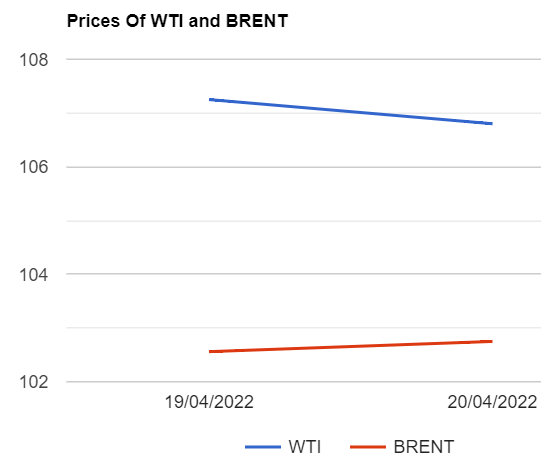

Brent oil futures for June delivery slipped 45 cents or 0.42 pct to close at $106.8 a barrel on London based ICE futures Europe exchange while WTI oil futures for May delivery edged 19 cents or 0.19% up to $102.75 a barrel on NYMEX last night. WTI may contract expired yesterday. In Shanghai, Crude oil main contract futures prices went 19.3 Yuan down to close at 676.6 Yuan/bbl where as MCX crude oil front month future prices dropped Rs.15 or 0.19 pct to Rs.7846 a barrel yesterday. Brent oil futures traded at a premium of $4.9 over WTI futures during the session.

The world crude oil price index curves moved flat yesterday as both the benchmarks closed unchanged yesterday. Following the IMF cutting global growth forecast that pushed oil prices down in the previous session continued to weigh on oil complex. IMF, citing the economic impact of Russia's war in Ukraine sent clear signals of inflation in many countries. Expected dampening oil demand and economic worries shrugged off bullish mood out of supply worries. Turning to weekly data, EIA reported that U.S crude, Gasoline and distillates stocks were drawn by 8Mbpd, 0.8Mbpd and 2.7Mbpd respectively during the last week. U.S exported most of its oil to world markets as other countries are slowly moving towards phase-in ban of Russian oil. Analysts are in the opinion that world markets will start build up stocks subject to the function of Libyan loss , whether CPC comes back fully this week and Russian export loss. Today, Asian markets opened in bullish mood and trading in green at the time of reporting. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com