By Srinivas Chowdary Sunkara // petrobazaar // 21st January 2020.

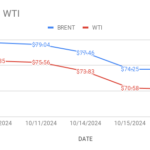

Brent oil futures prices for March delivery rose 35 cents to $65.2 on the London based ICE futures Europe exchange while U.S crude futures to be delivered in March gained 22 cents to $58.76 a barrel on the NYMEX. In Shanghai, The crude oil main contract futures edged up 0.6 Yuan or 0.13% at 466 Yuan/barrel where as MCX crude futures for Feb settlement closed Rs.20 up at Rs.4182 yesterday. Brent premium over WTI widened to $6.44 a barrel during the session.

The world benchmark crude oil futures price indexes showed slight upward momentum after two large crude production bases in Libya began shutting down that may risk to limit the crude flows from OPEC member country. However the earlier rise was limited after the analysts said that the current scale of outages to be fairly short-lived. On the contrary, If the outages are prolonged that would be enough to bring the global markets into deficit from surplus or any other OPEC member can offset the deficit. In other words, The bullish price impact may prove to be fleeting since fundamentals are not enough supportive. There was a thin activity in U.S market due to the Martin Luther Jr. holiday. Turning to data side, API predictions are due later today. Today morning, Asian markets opened up and it does not demonstrate any firm trend so far. Weekly numbers may spur some volatility. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com