By Srinivas Chowdary Sunkara // petrobazaar // 20th Feb 2020.

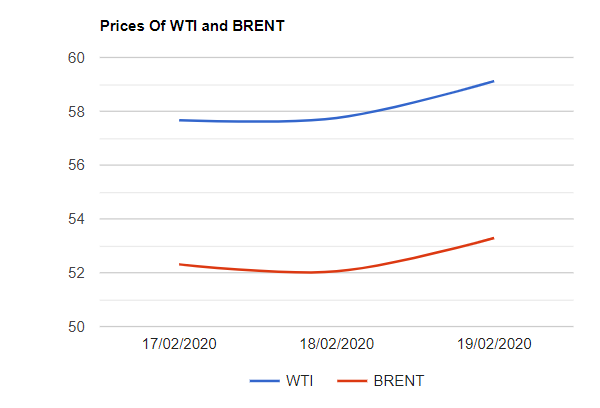

Brent futures for April settlement rose $1.37 or 2.37% to settle at $59.12 on the London based ICE Futures Europe exchange while WTI oil futures to be delivered in March traded $1.24 or 2.38% to close at $53.29 a barrel on the New York Mercantile Exchange. In Shanghai, Crude oil main contract futures edged up 5.7 Yuan or 1.4% to 413.5 Yuan/barrel where as MCX crude oil futures for Feb delivery settled Rs.112 up at Rs.3850 yesterday. Brent premium over WTI widened to $5.83 during the session.

The world benchmark indexes turned into upward momentum after the oil market shrugged off the virus news to catch up with world stock markets yesterday. The official data showed that the new corona virus cases in China fell for the second day, although the WHO did not approve the news. Oil prices were buoyed by the signs of prop up in oil demand as the Brent current month futures are moving into deeper backwardation, When near term prices are higher than later dated prices. Commodity trading houses and trading units of oil majors have hired oil storage in South Korea to keep crude in tanks until Chinese and general Asian demand is recovered from the virus outbreak affect.

Turning to weekly data, API data showed a build in U.S crude stocks by 4.2 Mb while gasoline and distillates are reportedly showed a dip of 2.7 Mb and 2.6 Mb during the last week. U.S government needs to approve the numbers later today. The consensus is on build in crude and gasoline while distillates inventories are predicted to be cut down. Turning to supply side, OPEC+ is considering to take a decision to further rein in supplies to prop up prices based on the slump in oil demand. Russians took time to review on the decision. Today morning, Oil markets opened with a gap up to continue yesterday's gains during the Asian hours. EIA numbers are expected to spur some volatility in the market today. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com