By Srinivas Chowdary Sunkara // petrobazaar // 19th July, 2019.

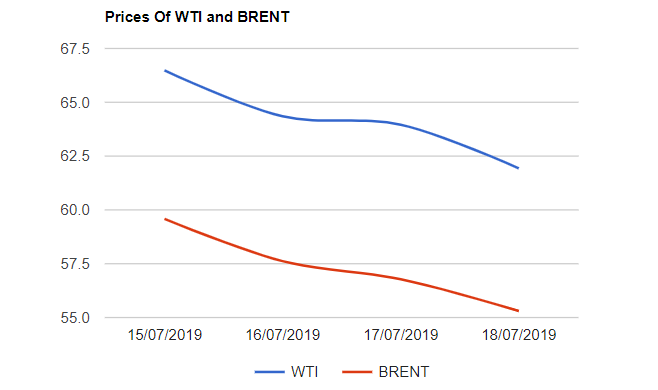

Brent price fell $1.73 to $61.93 and WTI prices settled $1.48 down at $55.30 a barrel last night. Shanghai crude oil main contract futures dropped by 11.4 Yuan or 2.54% at $437 while MCX crude futures closed Rs.81 at Rs.3835 yesterday. Both the global crude indexes went down by around 2.6%, Moving towards weekly loss.

Expected increase in barrels from gulf of mexico following the last week's hurricane in the region and weak economic concerns that weighed on U.S equities are the prevailing bearish factors that pushed oil prices down yesterday. Fundamentally speaking, Speculators are exiting from the market, Who tried to ride the whole storm and followed by sharp drawings last week. Piling up of U.S crude stocks this week indicated that the gasoline demand is faltering despite of driving season. Geo-political tensions exist in the market. The longer term outlook is increasingly bearish and prices may rise temporarily as the oil keep flowing as per market participants. Asian markets are opened up today. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com