By Srinivas Chowdary Sunkara // petrobazaar // 19th Oct, 2022.

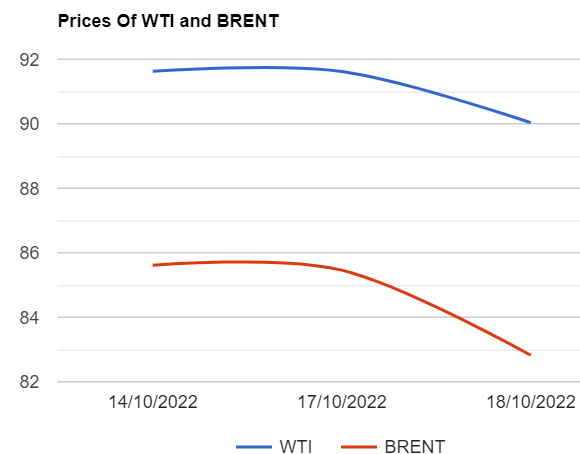

Brent oil futures for Dec delivery closed $1.59 or 1.74 pct down to $90.03 a barrel on London based ICE futures Europe exchange while WTI oil Nov futures prices settled $2.64 or 3.09 pct down to $82.82 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 4.7 Yuan to 675.7 Yuan/bbl where as MCX crude oil front month futures prices dropped Rs.222 to Rs.6842 a barrel yesterday. WTI futures traded at a discount of $7.21 a barrel over Brent during the session.

The world crude oil price index curves continued to demonstrate downside momentum for a straight third session. Both the benchmarks traded down on existing weak fundamentals like gloomy economic outlook that will deter demand growth and higher U.S supplies. China delay of releasing economic numbers that was originally scheduled to publish on Tuesday, Compounded existing lingering worries over demand destruction. Turning to weekly numbers, API estimated that U.S crude, gasoline and distillates stocks are drawn by 1.27Mbpd , 2.17Mbpd and 1.09Mbpd respectively during the last week. EIA will confirm numbers later today. Consensus is on drawings. Analysts expect that U.S will sell more oil from SPR to rein in oil price rally that was ignited by OPEC+ group proposal of 2Mmbpd cuts that attracted more buyers into oil futures and options during the last week to 11th. Asian markets are trading flat at the time of reporting in a choppy trading at the time of reporting.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com