By Srinivas Chowdary Sunkara // petrobazaar // 19th Oct, 2021.

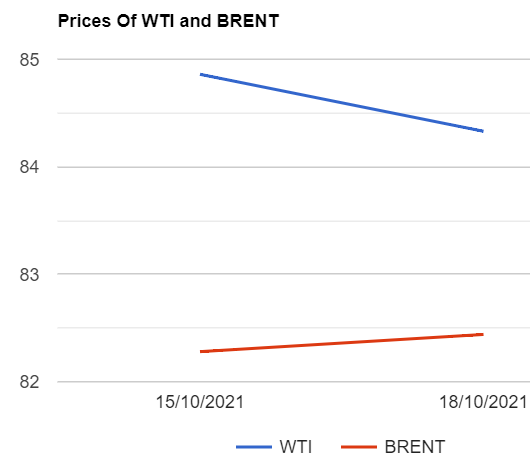

Brent oil futures prices for Dec delivery slipped 53 cents or 0.61 pct to close at $84.33 a barrel on London based ICE futures Europe exchange. WTI oil Nov futures prices inched up 16 cents or 0.19 pct to settle at $82.44 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 8.5Yuan to 543Yuan/bbl while MCX crude oil front month futures prices moved flat at Rs.6177 a barrel yesterday. Brent premium over WTI narrowed down to $1.89 a barrel during yesterday's trading.

Yesterday, The world crude oil price index curves moved up in early trading hours as markets started off with lot of exuberance on demand outlook amid rumblings over supply tightening across the world. Later on, Prices were pulled back as weak U.S factory data along with Chinese data compounded worries. Week end rig numbers signaled that U.S drillers may increase production also halted the rally. On the technical side, Fund managers realised profits over week end on higher oil prices. Hedge managers and other money managers sold the equivalent of 16Mb in the six most important petroleum related futures and options. There was unusually heavy concentration towards middle distillates such as U.S diesel and European gas oil due to its heavy demand. Turning to weekly data, API numbers are due later today followed by EIA confirmations. Today, Asian markets are opened in bearish mood, Trading in green zone at the time of reporting on persistent lingering concerns over demand and supplies.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com