By Srinivas Chowdary Sunkara // Petrobazaar // 18th August, 2021.

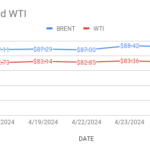

Brent oil futures prices for Oct delivery slipped 48 cents or 0.69 pct to $69.03 a barrel on London based ICE futures Europe exchange. WTI oil Sep futures prices closed 70 cents lower at $66.59 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went down 4.4 Yuan to 419.9Yuan/bbl while MCX crude oil front month futures prices settled Rs.44 lower at Rs.4952 a barrel yesterday. Brent traded at a premium of $2.44 a barrel over WTI during the session.

The world crude oil price index curves continued to descend for the fourth session in a row. Both the benchmark prices closed lower after demonstrating an upside momentum in the early trade. Anemic Asian demand and OPEC producers call for no need of more oil are the factors that undermined oil prices. Falling crude throughput in Chinese refineries compounded with weak factory output and retail sales in July exacerbated trader worries. Hedge Funds preferred to sell petroleum last week. Turning to weekly numbers, API estimated 1.163Mb and 1.1979Mb drawings in U.S crude and gasoline stocks respectively while distillates stock are expected to be piled up during the last week. Consensus is on draws. EIA will confirm numbers later today. Asian markets opened in green and it does not demonstrate any firm trend so far. Weekly numbers may spur some volatility today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com