By Srinivas Chowdary Sunkara // petrobazaar // 18th May, 2021.

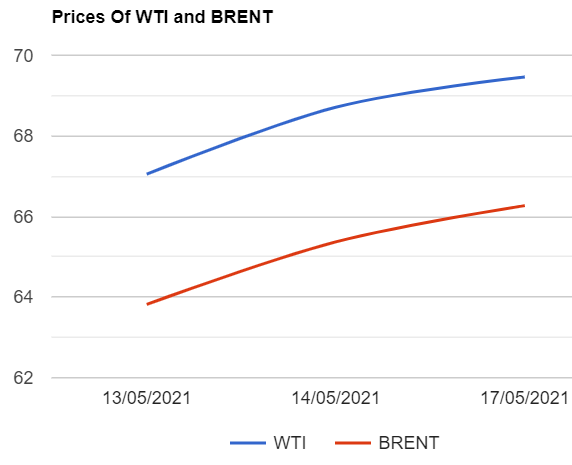

Brent oil futures for July delivery climbed 75 cents or 1.09% to $69.45 a barrel on London based ICE Futures Europe exchange. In U.S, WTI oil June futures prices rose 90 cents or 1.38 Pct to $66.27 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices spiked 12.2 Yuan to 426.7 Yuan/bbl while MCX crude oil current month futures prices went up Rs.77 to Rs.4863 a barrel yesterday. Brent premium over WTI narrowed down to $3.19 a barrel during the session.

The world crude oil price index curves continued to hover at high levels yesterday on reopening of European economy with accelerated vaccination rates. U.S positive demand outlook also lent support to oil complex. The market seems to be struck in between encouraging U.S demand and underwhelming Asian demand. Escalation of worries over rising virus cases in India and sluggish Chinese manufacturing numbers, Continued to press oil prices. On the technical side, Hedge funds cut their petroleum positions last week although hedge funds community is bullish on oil prices. Bullish long positions outnumber bearish shorts by 5.38:1. But, Fund managers have not added any significant number of positions over the last three months since the middle of Feb. API numbers are due later today. Today, Asian markets opened in green and trading up, Continuing previous session's gains. It doesn't demonstrate any firm trend so far. Weekly numbers may spur some volatility.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com