By Srinivas Chowdary Sunkara // petrobazaar // 17th Oct, 2019.

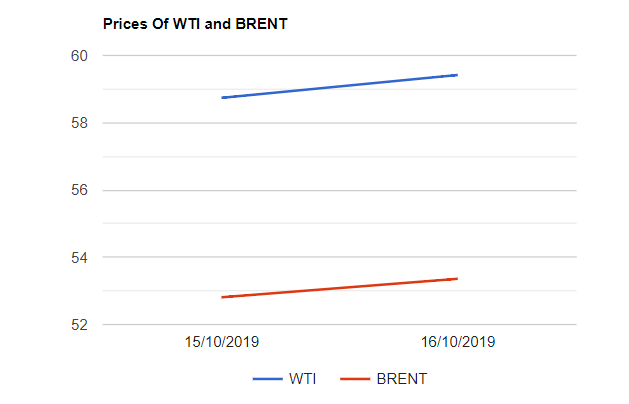

Brent oil prices rose 68 cents to $59.42 and WTI oil futures edged 55 cents up at $53.36 a barrel last night. In Shanghai, crude oil main contract futures dropped by 6.3 Yuan or 1.37% to 453.1 Yuan/barrel while MCX October futures closed down with an insignificant change of Rs.6 to Rs.3818 yesterday. Brent premium to WTI widened to $6.06.

The world crude bench mark price indices closed higher after a drop in the early trade due to demand worries amid gloomy economic growth sparked by trade irritants as indicated by IMF. Bearish talk on oil inventories also pressed the oil index in the early trade. Later on, Oil market put some light on producer's council meeting, Scheduled in Dec. Markets believed that the OPEC+ allies will agree to rein in supplies until world demand catches up with the supply situation, which averted the market mood. API report of swelling US inventories pared some of the gains in post settlement trade. The API reported that U.S crude supplies rose by 10.5Mb last week, Consensus is on 4Mb build. US government data will confirm the numbers later today.

I fully agree with Mr.Alahdal comment on missing strategy from OPEC in a price war hurry, Trying to prop up speculation with future demand predictions. Asian markets opened with gap down today and it does not demonstrate any firm trend so far. I fear that people flee the positions, if API numbers are confirmed. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com