By Srinivas Chowdary Sunkara // petrobazaar // 17th January 2020.

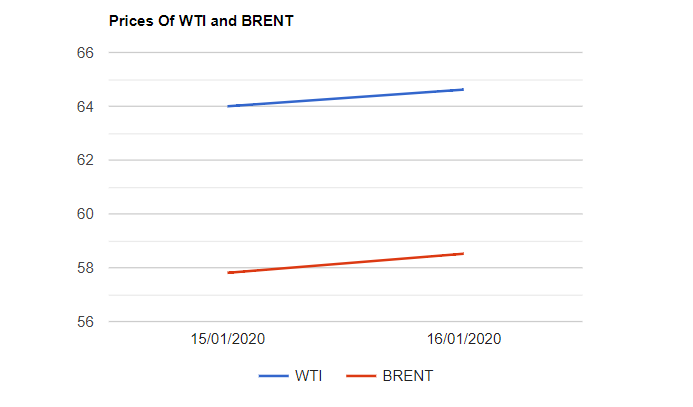

Brent oil futures prices for March delivery rose 62 cents to $64.62 on the London based ICE Futures Europe exchange while West Texas Intermediate futures prices to be delivered in February gained 71 cents at $58.52 a barrel on New York Mercantile Exchange. In Shanghai, crude oil main contract futures dropped by 3.2 Yuan or 0.69% at 463.6 Yuan/barrel while MCX crude futures for Feb delivery settled up Rs.78 at Rs.4178 yesterday. Brent premium stood at $6.1 over WTI during the session.

The World Crude oil price indexes turned into a slight upward correction with around 1% gains yesterday. Optimism surrounded the demand growth prospectus in 2020 followed by the U.S-China first phase of trade deal and a revamp of the U.S-Mexico-Canada free trade agreement. The energy complex was also supported by the strong manufacturing activity in the U.S Mid-Atlantic region. The IEA expected that oil production will outpace demand for crude from OPEC even if the group fully comply withe the pact to curb output, capped the gains in the early trade. UBS predicted that the Brent should touch a bottom of a $60-$65 per barrel trading range in the 1H20 before recovering to the top of it in the 2H20, provided that the middle east tensions do not intensify and cause production disruptions.

Today morning, Asian markets opened in green, extending yesterday's gains. Bulls may continue to celebrate today. Oil prices are heading towards slight weekly loss for the second straight week.

Good day and happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com