By Srinivas Chowdary Sunkara // petrobazaar // 16th February, 2019.

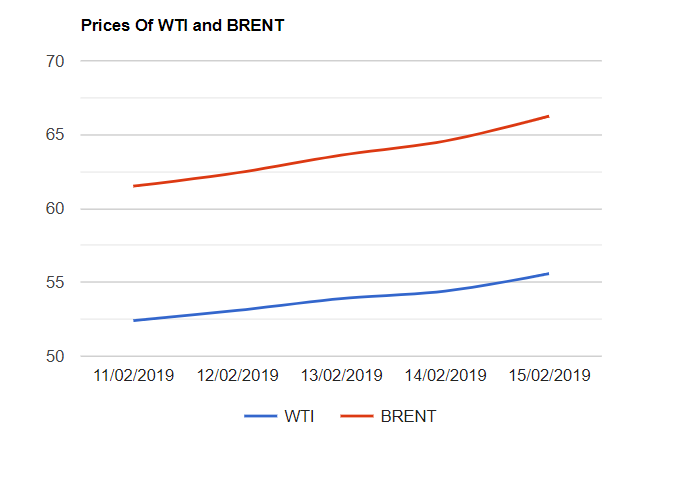

Brent prices rose $1.68 to the highest since Nov to close at $66.25 and WTI closed up by $1.18 to touch year's high at $55.59 a barrel last night. Both the crude markers advanced above 2 percent yesterday after a partial closure of offshore facility at Saudi. An outage at Saudi's Safaniya, Raised concerns over the availability of 1Mbpd, Boosted the expectation of tightening of oil supplies. Baker Hughes report of increase in three oil rigs limited the upside on Friday.

Crude Weekly Report

Oil futures ended the week with sizable gains as the Brent surged above 6 pct and U.S oil spiked above 5 percentage. The spread is widened to the highest during the week. Ongoing outages in Venezuela along with the OPEC+ voluntary cuts in January overshadowed the piling up of stocks and expected supplies from non-OPEC group. One of the largest bearish factor for Oil, U.S – China trade irritants showed some signs of easing also supported the oil prices this week. Good day and Happy week end.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com