By Srinivas Chowdary Sunkara // petrobazaar // 16th April, 2022.

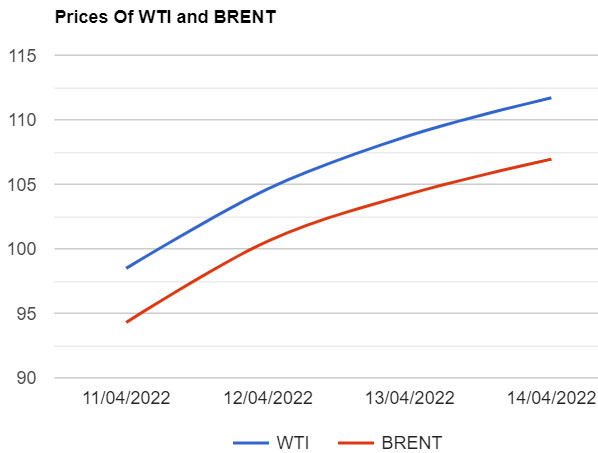

Brent oil futures for June settlement rose $2.92 or 2.68 pct to $111.7 a barrel on London based ICE futures Europe exchange while U.S crude grade, WTI oil futures to be delivered in May closed $2.7 or 2.59% higher to $106.95 a barrel on Thursday. In Shanghai, Crude oil main contract futures prices jumped 43.2 Yuan to 693.7 Yuan/bbl where as MCX crude oil front month futures prices settled higher to Rs.8078 a barrel during the session. Brent premium over WTI widened to $4.75 a barrel during the session.

The world crude oil price index curves continued to hover upside in a nervous trading after an early decline on Thursday. Both the benchmarks logged in weekly gains for the first time in April after two weeks of weekly losses. Traders adjusting their shorts ahead of long week end, Fears of wild price movements ahead of EU countries moving towards phase in ban of Russian oil are the factors pushed oil prices up. IEA warned that market is losing around 3Mbpd from Russia and OPEC warned that it is impossible to compensate missing Russians barrels. EIA reported ballooning up U.S crude stocks after tapping SPRs and China's through-put is expected to be trimmed are the other headlines during the week. Largest trading houses are avoiding to trade Russian's oil. Baker Hughes reported that U.S drillers added oil rigs during the last week. Higher oil prices spur drilling activity as per reports.

Happy week end and Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com